How To Start A 1099 Form

Step 1 - Select New for the form type if you are processingprintingfiling 1099s for the first time this year. Look for the 1099-G form youll be getting online or in the mail.

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

The separate instructions for filersissuers for Form 1099-NEC are available in the 2020 Instructions for Forms 1099-MISC and 1099-NEC.

How to start a 1099 form. To begin the 1099 process go to ActivitiesAccounts PayableProduce Vendor 1099s This will bring up the 1099 form selection dialog box. Hey everyone New to the forums here. The easy way to submit 1099-MISC to the IRS is online using the Filing Information Returns Electronically FIRE system.

Gather the required information Before you can complete and submit a 1099 youll need to have the following. Form 1099-NEC Nonemployee Compensation is transmitted with Form 1096 Annual Summary and Transmittal of US. You may not see 1099s for the.

You can make notes about where the receipt is located maybe an email folder or a physical file. Here are the steps to completing and submitting the 1099-NEC form. These forms are available online from the NC DES or in the mail.

You may owe Uncle Sam if you didnt withhold taxes. Before starting I need to form an LLC likely S-corp from what Ive been reading but not sure how to go about doing this. At the end of each year it is the responsibility of the person paying to provide a completed 1099 form to the person they pay.

A 1099 is a document or a series of documents used by the IRS to track different types of income other than salary received from an employer. Finishing fellowship soon and going to be working as a 1099 teleradiologist. Also if the filer uses paper filing then the filer must file the Form 1099-.

They should be labeled item cost date and then receipt. You cant use a scanned or PDF copy. To use this system you must be able to create a file in the proper format.

Here is a free excel template for 1099 contractors you can download and use. However before you are approved to use the system youll need to file IRS Form 4419 which is your application to file electronically at least 30 days before the due date of the 1099s. Independent contractors use a 1099 form and employees use a W-2.

How to file a 1099 form 1. Information Returns which is similar to a cover letter for your Forms 1099-NEC. For W-2 employees all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer.

If you forget your new password or need to reset it you can select Forgot Password on the login screen. You should see all of the available 1099 types in the dropdown. Youll start with a temporary password and then youll be prompted to create a new one.

Submit Copy A to the IRS Copy A of Form 1099-NEC must be submitted to the IRS by January 31 2021 regardless of. You can file 1099 forms and other 1099 forms online with the IRS through the FIRE System Filing Electronic Returns Electronically online. Im guessing the rules vary by state but I dont yet live in the state I.

How to file a 1099 form. Step 2 - Select the type of form you wish to print. If the filer uses electronic filing then the filer must file the Form 1099-Misc to the IRS by March 31st 2021.

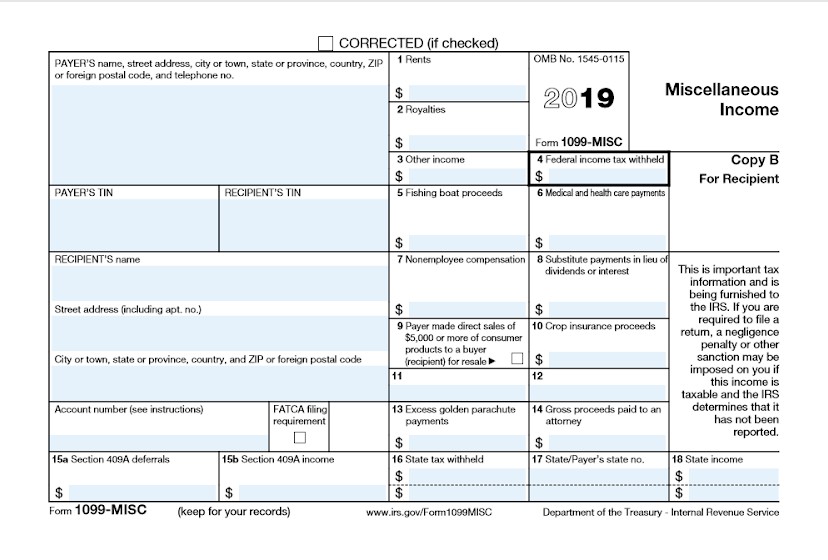

Submit copy B to the independent. Form 1099-MISC is titled Miscellaneous Income This form is used for a variety of payments but not for non-employees. A 1099-MISC form must be given to anyone to whom 600 or more has been paid during the year.

To get started create four columns. Forms 1099 and W-2 are two separate tax forms for two types of workers. Filers must file the 1099-Misc Form before the due date with the IRS.

Determine who is a contractor.

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

How To Fill Out 1099 Misc Irs Red Forms

How To Fill Out 1099 Misc Irs Red Forms

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

All You Need To Know About The 1099 Form 2020 2021

All You Need To Know About The 1099 Form 2020 2021

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

How To Read Your 1099 Robinhood

How To Read Your 1099 Robinhood

W9 Vs 1099 Irs Forms Differences And When To Use Them

W9 Vs 1099 Irs Forms Differences And When To Use Them

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile