How To Report Business Name Change To Irs

In that case if the taxpayer is due a refund it will take longer for them to get their money. How to Change Your Business Name with the IRS.

Https Www Irs Gov Pub Irs Prior F990ez 2020 Pdf

Be sure to include the previous name and EIN in the letter.

How to report business name change to irs. Heres what a taxpayer should do if anyone listed on their tax return changed their name. Must use Option 2. An organization that does not file an annual return for example an organization that instead files Form 990-N the e-Postcard or an organization that is required to e-File its return may report the change of name by letter or fax not by phone to.

Failing to report a name change. LLC sole member cannot update name by filing return. Check the name change box if you are filing a tax return for a corporation either Form 1120 or 1120S.

Name Change Due to Adoption. Simply check off name change at the top of Form 1120 when taxes are filed. If your LLC is taxed like a C-Corp you dont have to mail a special letter to the IRS.

Write to us at the address where you filed your return informing the Internal Revenue Service IRS of the name change. In the case of an adoption if the child has a Social Security number. If a name on a taxpayers tax return doesnt match SSA records it can delay the IRS processing of that return.

Changing your business name may require you to notify the IRS in addition to changing your EIN. One of the partners must sign the letter. An exempt organization that has changed its name must report the change on its next annual return such as Form 990 or 990-EZ.

If you are filing a current year return mark the appropriate name change box of the Form 1120 type you are using. Updating Your Business Name. Httpswwwirsgovindividualsbusiness-name-change Just write a letter on business letterhead to the IRS at the appropriate address noted in the instructions to the 1065 explaining that you changed from a partnership to an LLC in accordance with IL state law.

IRS change of business name can be done in two ways. Write a letter to the IRS that informs them of the name change. If such a business hasnt yet made any tax filings with the IRS it can send its business name change notice to the following address.

To change the name of a corporation at a time other than the annual tax filing. Taxpayers who should notify the SSA of a name change include. Write to the IRS at that address informing them of the name change.

All business tax types Withholding Petroleum Limited Liability Company LLC or. The notification must be signed by the business owner or authorized representative. The medium through which a business informs the IRS of its name change is determined by the kind of.

Recently married taxpayers who now use a hyphenated name. Attach a copy of the amended certificate of incorporation or other state-provided documentation that confirms the legal name change of the corporation and mail the letter and supporting documents to the IRS filing address. LLC taxed as an S-Corporation If your LLC is taxed like an S-Corp you dont have to mail a special letter to the IRS.

If you have a. Step 1 Identify your business as currently on file with the NYS Tax Department. Alternatively you can notify the IRS through a name-change letter.

Be sure to include the former name and EIN of the business. If your business is a partnership notify the IRS about the name change when you file your partnership information return on Form 1065 or you can write to the IRS including a notification form signed by a partner. On the Form 1120 the name change is indicated on page 1 Line E box 3.

If you have already filed the return for the current year you. An authorized person from your company must sign the letter. Corporations and LLCs can check the name change box while filing their annual tax return with the IRS.

Report of Address Change for Business Tax Accounts Identification numberwith suffix if any Legal name see instructions Trade name DBA Step 2 Select tax types to change in Step 3. Locate the address where your annual tax return is submitted. A name mismatch can delay a tax refund.

Limited Liability Company LLC. If you change the name of your partnership or corporation you must include a copy of the Articles of Amendment that you filed with your state to authorize the name change. Reporting Taxpayers Name Change.

Corporations Form 1120 Page 1 Line E Box 3. Taxpayers who got married and use their spouses last name. On the 1120S the same box is found on page 1 Line H Box 2.

S-Corporation Form 1120S Page 1 Line H Box 2. Send a letter signed by the business owner or an authorized representative to the same address where you file your tax returns. IRS-Stop 343G Cincinnati OH 45999.

When filing a current year tax return you can change your business name with the IRS by checking the name change box on the entitys respective form.

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

3 17 277 Electronic Payments Internal Revenue Service

3 17 277 Electronic Payments Internal Revenue Service

3 13 5 Individual Master File Imf Account Numbers Internal Revenue Service

3 13 5 Individual Master File Imf Account Numbers Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

What Is A W 9 Form How Do I Fill Out A W 9 Gusto

What Is A W 9 Form How Do I Fill Out A W 9 Gusto

Learn How To Fill Out A W 9 Form Correctly And Completely

Learn How To Fill Out A W 9 Form Correctly And Completely

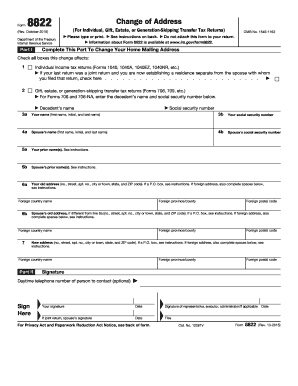

Form 8822 Fill Out And Sign Printable Pdf Template Signnow

Form 8822 Fill Out And Sign Printable Pdf Template Signnow

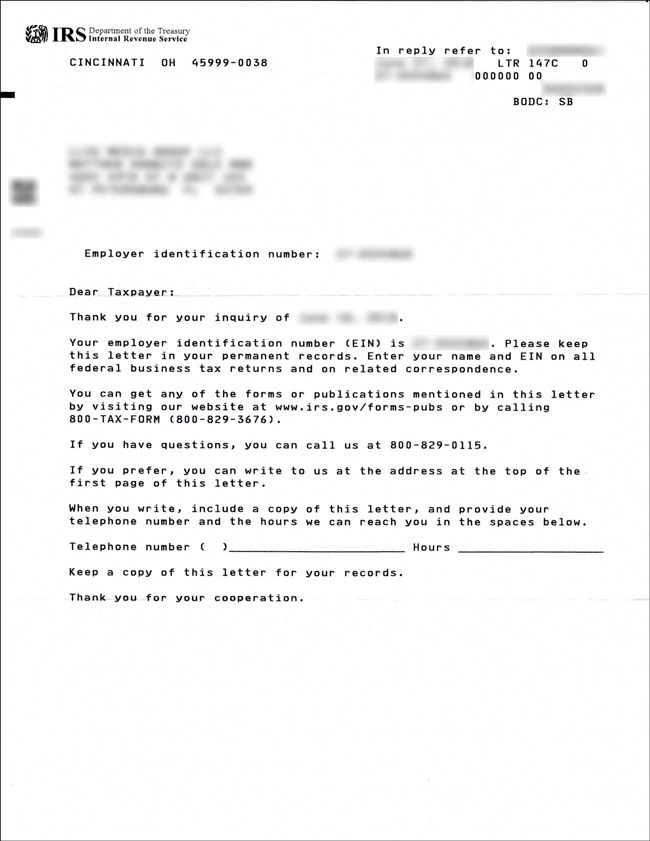

How To Get Copy Of Ein Verification Letter 147c From The Irs

How To Get Copy Of Ein Verification Letter 147c From The Irs

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

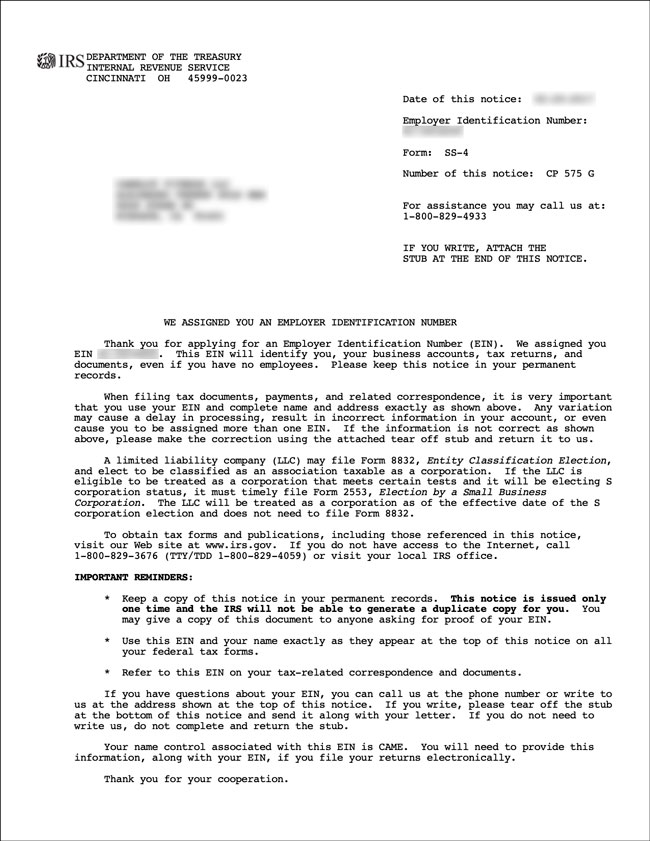

How To Change Your Llc Name With The Irs Llc University

How To Change Your Llc Name With The Irs Llc University

How To Get Copy Of Ein Verification Letter 147c From The Irs

How To Get Copy Of Ein Verification Letter 147c From The Irs

Irs Audit Letter 4464c Sample 1

Properly Completing Irs Form W 9 For Your Ira Llc Or Checkbook Control Ira Self Directed Ira Handbook

Properly Completing Irs Form W 9 For Your Ira Llc Or Checkbook Control Ira Self Directed Ira Handbook

Explore Our Example Of First B Notice Form Template Lettering Letter Templates Letter Writing Template

Explore Our Example Of First B Notice Form Template Lettering Letter Templates Letter Writing Template

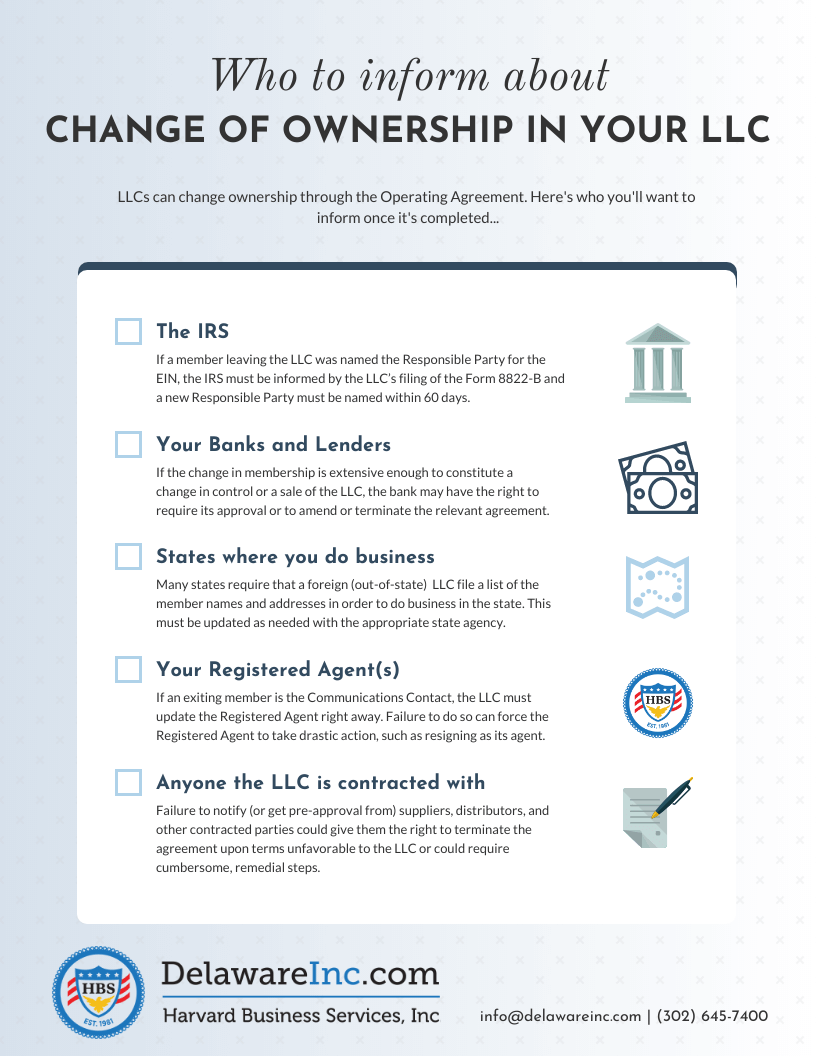

Who To Inform About Your Llc Change Of Ownership Harvard Business Services

Who To Inform About Your Llc Change Of Ownership Harvard Business Services

Change Your Business Name With The Irs Harvard Business Services

Change Your Business Name With The Irs Harvard Business Services