How To Prepare A K1 For An Llc

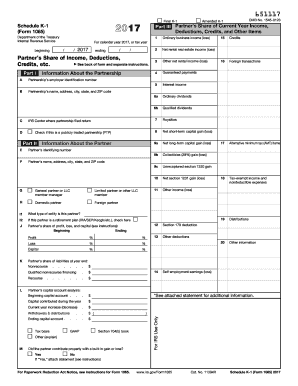

Schedule K-1 lists the members income. Schedule K-1 is a schedule of IRS Form 1065 that members of a business partnership use to report their share of a partnerships profits losses deductions and credits to the IRS.

Learn how to fill out your Schedule K-1 quickly and accurately.

How to prepare a k1 for an llc. Heres where to send the different K-1 forms. One of many options for business type that owners have is an S corporation commonly referred to as an S corp. Owners of an LLC are called members.

Then mail it to the state department where the LLC is registered along with the change fee which is usually between 40 and 150 dollars depending on your state. Return of Partnership Income. Fill out an Article of Amendment template which can be found online.

You will include the Schedule K-1 in your personal tax return. Most states do not restrict ownership so members may include individuals corporations other LLCs and foreign entities. The S corporation provides Schedule K-1s that reports each shareholders share of income losses deductions and credits.

The K-1 is prepared by the entity to distribute to ownersshareholders to outline their portion of the income loss and deductions. Have management members sign the document. Schedule K-1 is also known as Form 1065 US.

You can also file the form by mail. If you are an owner of a partnership LLC S-corp or other entity that passes through taxes to its owners in most cases you will receive a K-1 form each year. S corporations partnerships and LLCs are considered pass-through business types because the businesss income passes through to the owners on their personal tax returns.

Schedule K-1 Form 1120S. You dont list the businesss total earnings on it only the members individual share of business earnings. If you operate a pass-through entity you must fill out a Schedule K-1 tax form.

The tax form reports the participation of each member in the business income deductions and tax credit items. This means that the LLCs income and expenses are distributed to the members using a Form K-1. Each owner should show their pro-rata share of partnership income credits and deductions on Schedule K-1 1065 Partners Share of Income Deductions Credits etc.

But one-member LLCs must report as if they were a sole proprietorship using Schedule C. Each partner gets a copy of his or her Schedule K-1. The easiest thing to do is to submit the form electronically by using IRS Free File or tax prep software.

You can file your Schedule K-1 form when you submit your Form 1065 or 1120S to the IRS. What Is a Schedule K-1. By Christine Funk JD.

Members use the information on Schedule K-1. What is Schedule K-1. For more advice on LLC amendment rules read more from our Legal co-author.

Each state may use different regulations you should check with your state if you are interested in starting a Limited Liability Company. How do I file my own Schedule K-1 form. Httpsyoutube8qzQop2xPZYhttpsyoutubetCiv1p0__JINeed help organizing or catching.

Return of Partnership Income. Confused if you need to file 1065schedule K-1. Schedule K-1 for S corporations.

When an LLC has more than one member the IRS automatically treats it as a partnership for tax purposes. Along with Form 1065 youll issue a Schedule K-1 to all company members. The shareholders use the information on the K-1 to report the same thing on their separate tax returns.

Part of the partnership tax return is a Schedule K-1 for each partner. However often times the LLCs name and EIN will be listed as the partner on the K-1 and then the accountants issuing the K-1 ie the accountants for the Project entity will say that the partners IRA-owned LLCs tax classification is partnership see Part III line I1 of the K-1 form. To prepare the Form 1065 partnership return for the LLC you have to use TurboTax Business which is not the same as TurboTax Home Business.

Youll fill out Schedule K-1 as part of your Partnership Tax Return Form 1065 which reports your partnerships total net income. You must also provide copies of. In these businesses income tax returns are prepared by the.

Schedule K-1 is not reported on a Schedule C. In this case they do not have to present Schedule K-1. A Schedule K-1 form is used to report individual partner or shareholder share of income for a partnership or S corporation.

TurboTax Business is available only as CD or download software and only for Windows. A Limited Liability Company LLC is a business structure allowed by state statute. If the LLC is a partnership normal partnership tax rules will apply to the LLC and it should file a Form 1065 US.

You can use Turbo Tax Premier to include K-1 information. Similar to a partnership S corporations must file an annual tax return on Form 1120S. How to Prepare a Final K-1 for an S Corp.

Form 1065 Schedule K-1 an informational document reporting your LLCs income deductions gains and losses. This tax return can be prepared using Turbo Tax Business. To file your taxes you must submit Form 1065 and Schedule K-1.

In this instance the LLC must issue K-1s to all the members reporting all income credits and deductions based on the members share of ownership. Instead the LLC needs to prepare and file Partners Share of Income Deductions Credits etc.

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

3 Ways To Fill Out And File A Schedule K 1 Wikihow

3 Ways To Fill Out And File A Schedule K 1 Wikihow

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

I Received A K 1 What Is It The Turbotax Blog

5 Amazing Benefits Of Nettle Tea Www Gabriela Green Nettles Tea Herbalism Nettle Tea Benefits

5 Amazing Benefits Of Nettle Tea Www Gabriela Green Nettles Tea Herbalism Nettle Tea Benefits

3 0 101 Schedule K 1 Processing Internal Revenue Service

3 0 101 Schedule K 1 Processing Internal Revenue Service

3 0 101 Schedule K 1 Processing Internal Revenue Service

3 0 101 Schedule K 1 Processing Internal Revenue Service

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

K1 Form Fill Out And Sign Printable Pdf Template Signnow

K1 Form Fill Out And Sign Printable Pdf Template Signnow

What Is A Multi Member Llc Advantages Disadvantages Explained Gusto

What Is A Multi Member Llc Advantages Disadvantages Explained Gusto

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Adjustment Of Status X2f Aos From A K1 Visa Life As Mrs Presson Cover Letter Sample Sample Cover Cover Letter

Adjustment Of Status X2f Aos From A K1 Visa Life As Mrs Presson Cover Letter Sample Sample Cover Cover Letter

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto