How To Get A 1099 Form 2019

Collect the required information about each independent contractor you hired during the last year. 1-888-209-8124 This is an automated phone line that allows you to request your 1099-G via US.

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

Fortunately you can still file your taxes without it and regardless of whether or not you receive a 1099-NEC you must still file taxes with the IRS.

How to get a 1099 form 2019. Click on the link to the document you want to e-sign and select Open in signNow. You can conduct the automated services 24 hours a day. Check out our Frequently Asked Questions web page on how to obtain a replacement 1099.

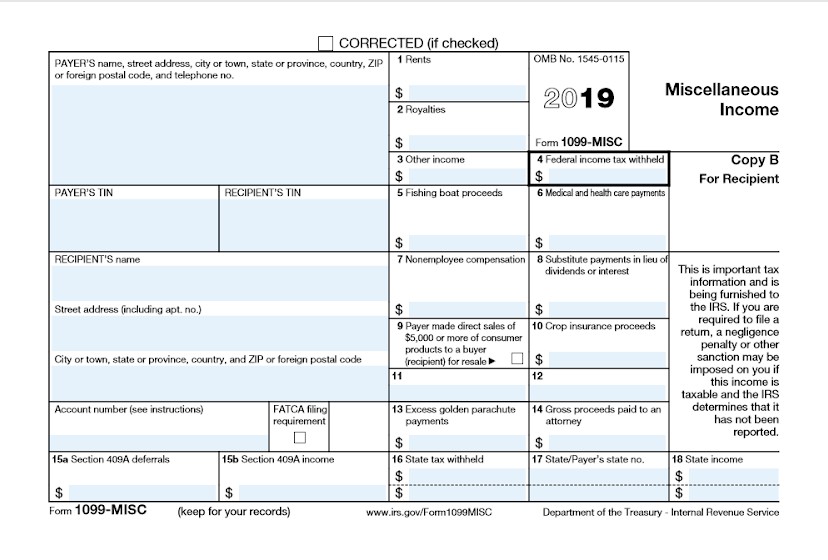

Miscellaneous Income Info Copy Only 2019 Inst 1099-MISC. You cant use a scanned or PDF copy. The payer should send you a copy of your 1099 by January 31st.

How to Get Your 1099-G online. Forms requested after 33121 will have to be filed with your 2022 taxes. We hope this helps.

If you need help determining how much youve made in 2020 you can refer back to your Weekly Pay Statements sent via email. At least 10 in royalties or broker payments in lieu of dividends or tax-exempt interest. Follow these steps to properly prepare for completing your printable 1099 tax form 2019.

In some cases youll still need to source blank 1099 form 2019s but you can rest assured that your information will be correct and that you wont be late again. Click on the product number in each row to viewdownload. The guidelines below will help you create an e-signature for signing 2019 form 1099 misc irsgov in Chrome.

Select a category column heading in the drop down. 15 For simple investment calculations like interest and dividends 31 days is more than enough to expect financial institutions to get. You also may be able to request a replacement SSA-1099 by using our automated telephone service at 1-800-772-1213.

It should show all Forms 1099 issued under your Social Security number. If you do not have an online account with NYSDOL you may call. Enter a term in the Find Box.

To use this system you must be able to create a file in the proper format. Instructions for Form 1099-MISC Miscellaneous Income 2019 Form 1099-MISC. W2 - 1099 Forms Filer Pricing.

How to request your 1099-R tax form by mail Sign in to your account click on Documents in the menu and then click the 1099-R tile. Need a replacement copy of your SSA-1099 or SSA-1042S also known as a Benefit Statement. Department of the Treasury - Internal Revenue Service.

Launch the Payable app and log in to your account. At least 600 in. Click on column heading to sort the list.

How do I get a copy of my 2019 1099 - Answered by a verified Social Security Expert We use cookies to give you the best possible experience on our website. Theres a menu on the left pull it out and tap on My Account at the bottom. Log in to your registered account.

Access your 1099 tax forms printable at our website. Instructions for Form 1099-MISC Miscellaneous Income 2018 Form 1099-MISC. You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account.

Get a copy of your Social Security 1099 SSA-1099 tax form online. Miscellaneous Income Info Copy Only 2018 Inst 1099-MISC. If you worked as an independent contractor or received any other payment that needs to be reported on a 1099 then you should reach out to the person or business that paid you.

File with Form 1096. At the prompt indicate that youre requesting a replacement SSA-1099. To access this form please follow these instructions.

Forms and Publications PDF Instructions. You can also access your account by tapping on your profile picture in. File Form 1099-MISC for each person to whom you have paid during the year.

Dont worrythere are easy ways you can retrieve the forms you need to file. You must make all requests for 2020 1099-Gs before 33121 in order to receive the form for this tax year. Then file those documents directly from the software.

Use the data gathered through AMS Payroll to fill out and complete W2 and 1099 forms. Find the extension in the Web Store and push Add. Can They Deliver This Form Another Way.

By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. Well send your tax form to the address we have on file. An alternative to asking an issuer for a Form 1099 is to get a transcript of your account from the IRS.

You can verify or change your mailing address by clicking on Profile in the menu and then clicking on the Communication tab. Do not report the incorrect 1099-G income on your tax return. For Privacy Act and Paperwork Reduction Act Notice see the.

2019 General Instructions for Certain Information Returns. You may be able to enter information on. You can file 1099 forms and other 1099 forms online with the IRS through the FIRE System Filing Electronic Returns Electronically online.

For Internal Revenue Service Center. You do not need your corrected 1099-G form to file your tax return. Form 1099-B and some similar forms.

Irs Introduces New Ish Form To Replace Parts Of Form 1099 Misc Taxgirl

Irs Introduces New Ish Form To Replace Parts Of Form 1099 Misc Taxgirl

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Understanding 1099 Form Samples

Understanding 1099 Form Samples

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

W9 Vs 1099 Irs Forms Differences And When To Use Them

W9 Vs 1099 Irs Forms Differences And When To Use Them

Schwab Moneywise Calculators Tools Understanding Form 1099

Schwab Moneywise Calculators Tools Understanding Form 1099

1099 Forms And More At Everyday Low Prices Discounttaxforms Com

1099 Forms And More At Everyday Low Prices Discounttaxforms Com

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager