Are Receipts Necessary For Business Expenses

Supporting documents include sales slips paid bills invoices receipts deposit slips and canceled checks. You should also write helpful notes on the receipt including the name title and company of the client you entertained and the date location cost and purpose of the expenditure.

Are You Unsure What Expenses Are Deductible For You Business This Infographic List The Most Business Expense Bookkeeping Business Small Business Bookkeeping

Are You Unsure What Expenses Are Deductible For You Business This Infographic List The Most Business Expense Bookkeeping Business Small Business Bookkeeping

Apr 02 2021 Purchases sales payroll and other transactions you have in your business will generate supporting documents.

Are receipts necessary for business expenses. For example this may apply if the expense is for transportation and its not easy to get a proper receipt or the employee is reporting a meal expense under a per diem allowance. The more legitimate deductions you can take the lower your taxable income will be. Mar 16 2021 Yes they will ask for documentation but they also prefer that documentation to be digital.

Note that optional dues such as club or pool memberships are not deductible because. May 18 2016 Although receipts are not absolutely necessary they are the best way to prove an expense. So what are the must-dos that business owners like you should keep in mind while handling your expense keeping.

Jul 19 2016 Lastly you will have no choice but to pay a much higher tax as you will not have the ample receipts or documentation to prove that your expenses were business related. While every business is different here are some examples of business-related purchases you might make. Keep the receiptsinvoices if you spend money on.

Receipts along with bills and canceled checks tell your business history. If you purchase a 2000 computer or take a business trip across the country and dont have any receipts for costs you cant deduct them as business expenses. The IRS requires receipts over 75.

Nov 13 2019 Official Receipts are necessary to reduce taxable income. Cardinal rules of receipt keeping. Aug 22 2016 Deductions need to be traced back to where an expense occurred.

Nov 20 2020 Receipts are proof of your business expenses. Jun 25 2019 If so you cannot deduct the item as an ordinary and necessary. May 29 2020 The shoe-box method is not really recommended but you can write down a business expense as it occurs and place the related receipt into an envelope for reference.

Jul 10 2019 Expenses that are less than 75 or that have to do with transportation meals or lodging might not require a receipt. Theyre a lifesaver in the rare chance youre audited or asked to show documentation. These documents contain the information you need to record in your books.

Expenses relating to the purchase of a service will not be considered as an allowable deduction to taxable income if it is not supported by an Official Receipt. First and foremost you must keep all your work-related. They are legally required to accept digital forms of proof including bank and credit card statements.

If youre self-employed as a sole proprietor independent contractor or partner you have a choice between calculating the deduction using the standard mileage rate or with actual car expenses. Mar 27 2017 You want to keep your business receipts because nearly every business expense is deductible. This could include web hosting business cards ads in magazines or online billboards etc.

The BIR requires that all such expenses be substantiated. Without the evidence from receipts for your claimed business expenses the Canada Revenue Agency CRA may decide to reduce the number of expenses you have deducted. A missing receipt could cost your company money and put you at risk for an audit.

Sep 24 2012 The IRS does not require that you keep receipts canceled checks credit card slips or any other supporting documents for entertainment meal gift. That means more money back in your pocket to invest in your business or to spend however you want. Jan 03 2020 All of your claimed business expenses on your income tax return need to be supported with original documents such as receipts.

If you only have a few expenses. Car and Truck Expenses. At worst you might need to look up receipts for your bigger expenses -- a new laptop from Best Buy a desk from Amazon -- that kind of thing.

The more you can lower your taxable income the fewer taxes youll pay. It is important to save receipts for every expense you deduct on your taxes including mortgage rent insurance utility bills and mandatory homeowners association dues.

Organize Small Business Taxes Plus Free Printables Small Business Tax Small Business Organization Business Tax

Organize Small Business Taxes Plus Free Printables Small Business Tax Small Business Organization Business Tax

Don T Be Caught Unprepared When It Comes Time To File Taxes Get It Together With A Few Simple Ti Receipt Organization Small Business Organization Business Tax

Don T Be Caught Unprepared When It Comes Time To File Taxes Get It Together With A Few Simple Ti Receipt Organization Small Business Organization Business Tax

Quick Tip Storing Receipts Megan Nielsen Patterns Blog Small Business Organization Small Business Bookkeeping Receipt Organization

Quick Tip Storing Receipts Megan Nielsen Patterns Blog Small Business Organization Small Business Bookkeeping Receipt Organization

Keeping Track Of Receipts For Your Small Business Is Very Important It Keeps You Organized Ke Small Business Organization Business Tax Small Business Finance

Keeping Track Of Receipts For Your Small Business Is Very Important It Keeps You Organized Ke Small Business Organization Business Tax Small Business Finance

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

3 Necessary Actions For New Small Business Navigate With Price Small Business Bookkeeping Starting A Business Bookkeeping Services

3 Necessary Actions For New Small Business Navigate With Price Small Business Bookkeeping Starting A Business Bookkeeping Services

6 Tax Write Offs For Independent Contractors Www Utdu Info Independentcontractor Selfemployed Freelancers T Tax Write Offs Small Business Tax Business Tax

6 Tax Write Offs For Independent Contractors Www Utdu Info Independentcontractor Selfemployed Freelancers T Tax Write Offs Small Business Tax Business Tax

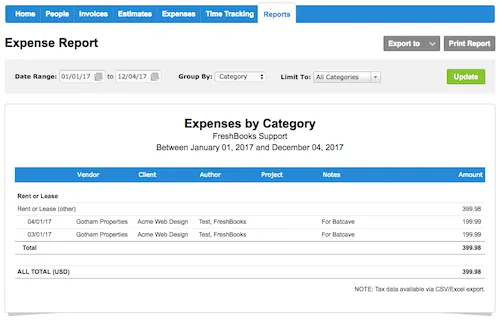

What Is An Expense Report And Why They Re Important For Small Businesses

What Is An Expense Report And Why They Re Important For Small Businesses

Should You Approve Work Related Expenses Without Receipts Appzen

Should You Approve Work Related Expenses Without Receipts Appzen

Expense Report Sample Template Templates Business Template Business Expense

Expense Report Sample Template Templates Business Template Business Expense

Why Keep Your Receipts Exceptional Tax Services Small Business Bookkeeping Bookkeeping Creative Small Business

Why Keep Your Receipts Exceptional Tax Services Small Business Bookkeeping Bookkeeping Creative Small Business

Diy In 123 Steps In How To Organize Receipts For Tax Season Receipt Organization Diy Taxes Tax Organization

Diy In 123 Steps In How To Organize Receipts For Tax Season Receipt Organization Diy Taxes Tax Organization

Free Business Expense Spreadsheet Small Business Tax Deductions Small Business Tax Business Tax Deductions

Free Business Expense Spreadsheet Small Business Tax Deductions Small Business Tax Business Tax Deductions

When Do I Need To Attach A Receipt To My Expense Reports

When Do I Need To Attach A Receipt To My Expense Reports

13 Business Expenses You Definitely Cannot Deduct

13 Business Expenses You Definitely Cannot Deduct

Which Receipts Do You Need To Keep As A Small Business Owner

Which Receipts Do You Need To Keep As A Small Business Owner

How To Organize Your Receipts The Easy Way With Google Drive The Dough Roller Receipt Organization Organizing Paperwork Google Drive

How To Organize Your Receipts The Easy Way With Google Drive The Dough Roller Receipt Organization Organizing Paperwork Google Drive