What Is An Ato Activity Statement

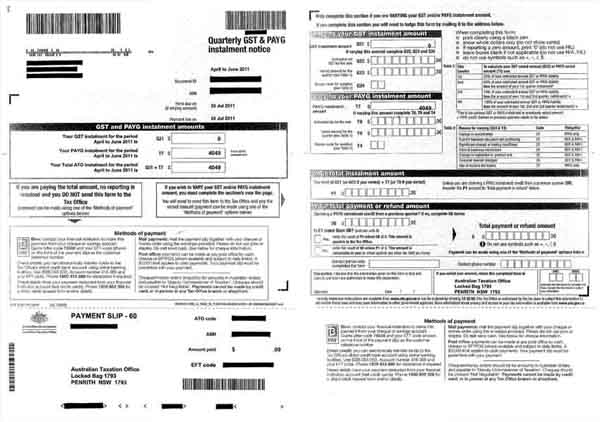

Business activity statements BAS If you are a business registered for GST you need to lodge a business activity statement BAS. An IAS or Instalment Activity Statement is a form used by taxpayers who are not registered for Goods and Services Tax GST.

How Is The W1 Figure Calculated In My Bas Ps Support

How Is The W1 Figure Calculated In My Bas Ps Support

Ask questions share your knowledge and discuss your experiences with us and our Community.

What is an ato activity statement. ATO Community is here to help make tax and super easier. An Instalment Activity Statement or IAS is a form used by taxpayers who are not registered for the GST. Currently I have been charged for Activity Statement 001 - Self Assessment Pay.

You must lodge an activity statement for each reporting period if your organisation has any PAYG FBT or GST tax obligations even if the amount to. The email is not from the ATO and it is not a legitimate activity statement notification. This is time-consuming as it requires double handling of data and the need for multiple systems.

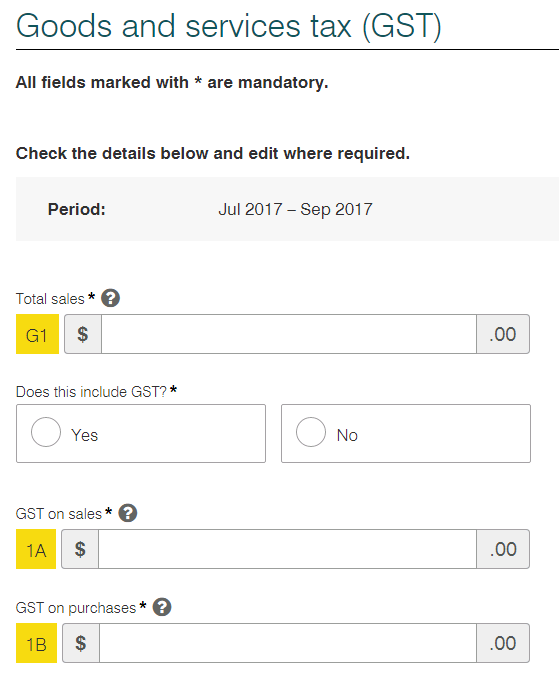

Complete your Activity Statement and submit it to the ATO without leaving Xero. A Business Activity Statement BAS summarises the tax that your business has paid. A personalised activity statement sets out the due dates as well as the period it covers for each of your tax obligations.

T7 ATO instalment amount on your activity statement or instalment notice shows the instalment amount worked out by us or your most recent varied amount. PAYGW is sometimes known as Income Tax Withholding ITW PAYGI is. Changed government or administrative priorities.

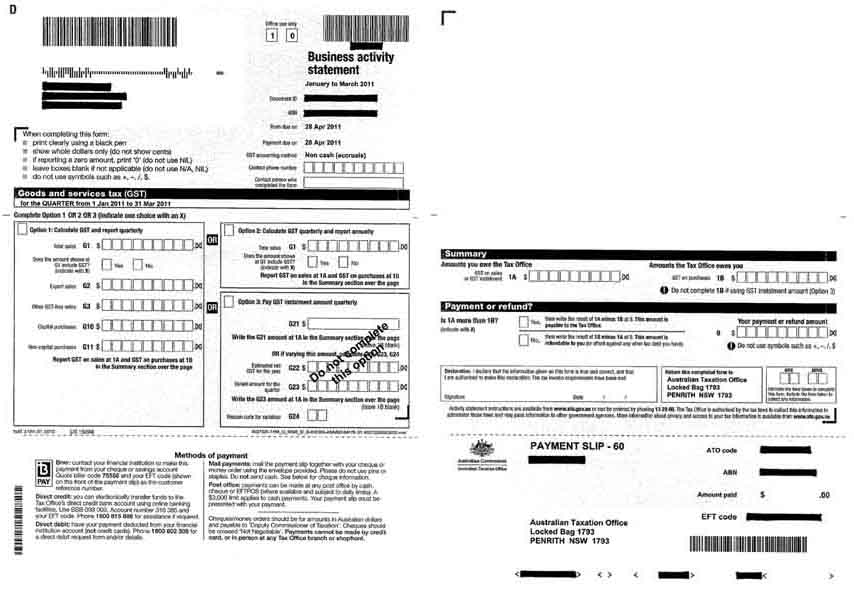

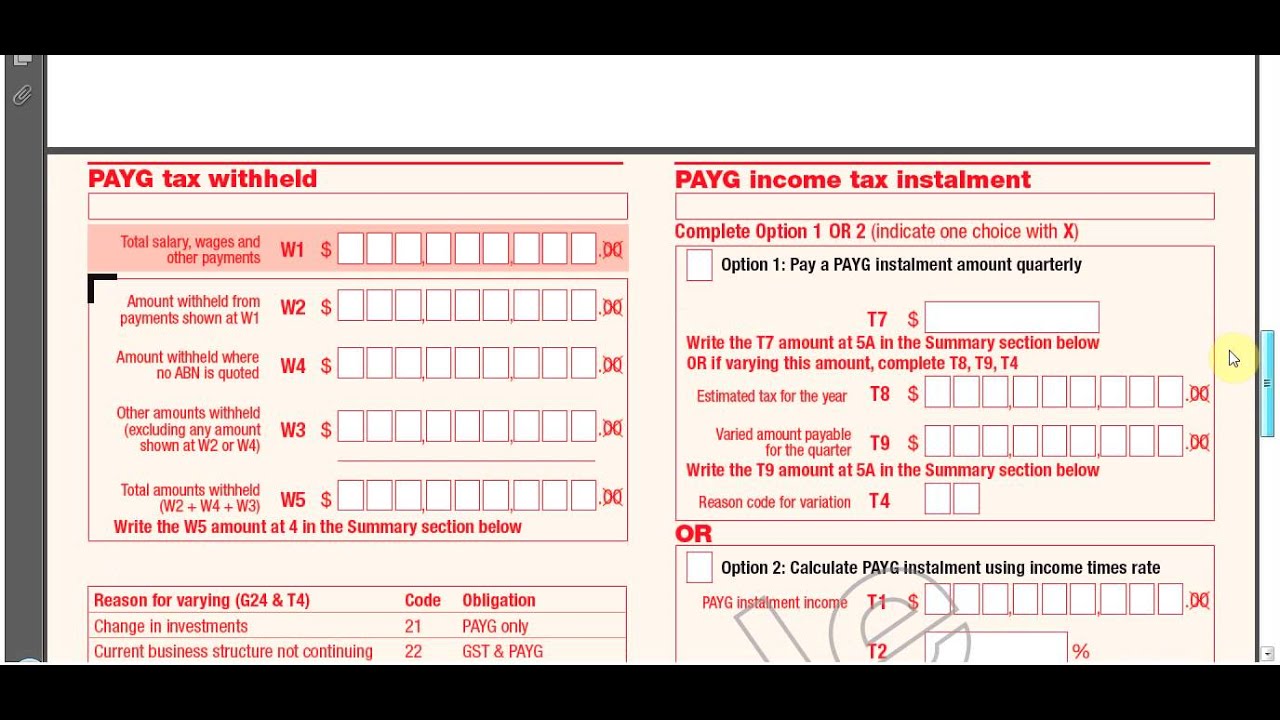

Activity statements Activity statements are issued by the ATO so that businesses can report and pay a number of tax liabilities on the one form at the one time. The business activity statement BAS is a form submitted to the Australian Taxation Office ATO by registered business entities to report their tax obligations including GST pay as you go withholding PAYGW pay as you go instalments PAYGI fringe benefits tax FBT wine equalisation tax WET and luxury car tax LCT. To lodge an Activity Statement from Xero you need the Submit BAS user permission.

Everything you always wanted to ask about Activity Statements. These are designed to support the reporting requirements for various obligations. In a PLS activity statement form type is a new mandatory field.

A user with the Manage Users permission can give you access to this. ATO has introduced 19 activity statement form types in PLS. Call the ATO to approve the connection to your organisationThe connection process is different for tax agents.

Goods and services tax GST pay as you go PAYG instalments. How you complete your BAS depends generally on your business registrations and whether you lodge your statement monthly or. This field must be completed when creating an activity statement manually and must match the ATO records.

We provide planned activity statement generation dates throughout the financial year. You dont have any other obligations that require a business activity statement just pay the amount you dont need to lodge the activity statementinstalment notice. The IAS is also the form required to be lodged by entities that prepare a quarterly BAS but are required to remit their PAYG withholding tax on a monthly basis because they are a medium withholder.

A generate date may change at short notice in the event of. Currently Xero partners BAS agents and tax agents can use Xero Tax to lodge activity statements or manually re-enter information from Xero into a form either through the ATO portal using alternative software or filling in a paper form. If you dont want to change the amount and.

An IAS or Instalment Activity Statement is a pre-printed document issued monthly by the Australian Taxation Office ATO which summarises the amounts of Pay As You Go PAYG instalments PAYG withholding and ABN withholding. Ask questions share your knowledge and discuss your experiences with us and our Community. If you own a business in Australia you must report and pay your business taxes to the Australian Taxation Office ATO using a Business Activity Statement BAS.

Clicking the link downloads a zip file that harbours a malicious JavaScript file. Your BAS will help you report and pay your. There are two types of activity statements an instalment activity statement IAS and a business activity.

Activity statement generate dates. ATO Community is here to help make tax and super easier. Lodge your BAS to the ATO at regularly intervals either monthly quarterly or annually.

Email purporting to be from the Australian Taxation Office ATO claims that you can click a link to download your next online activity statement. Activity statements are produced based on data extracted from our records on these dates.

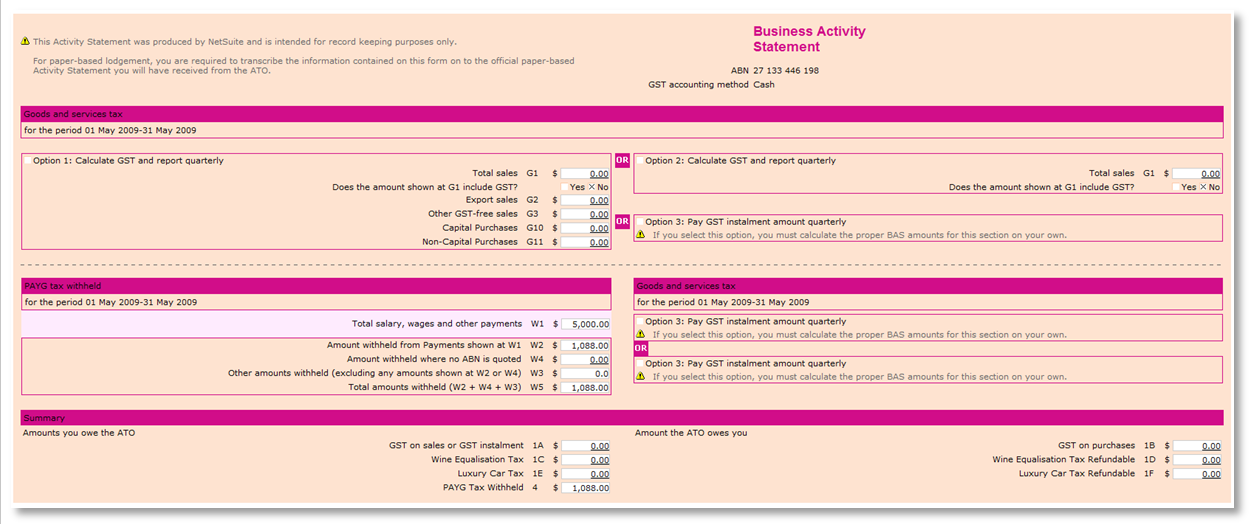

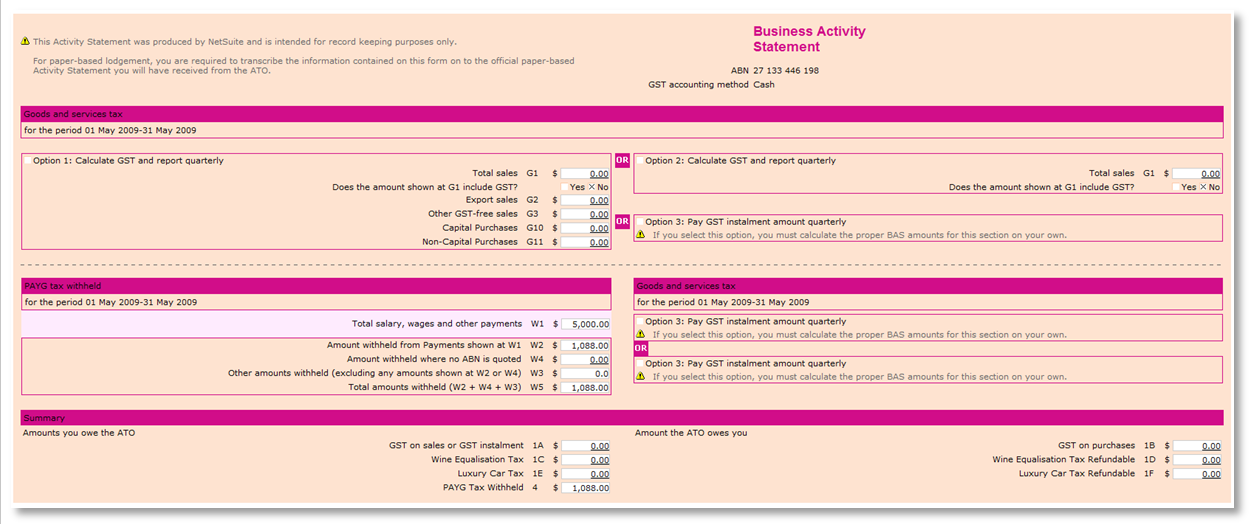

Bas Payment Of Gst Payg Jcurve Solutions

Bas Payment Of Gst Payg Jcurve Solutions

Business Activity Statement Bas Return All Sorted Bookkeeping Services

Business Activity Statement Bas Return All Sorted Bookkeeping Services

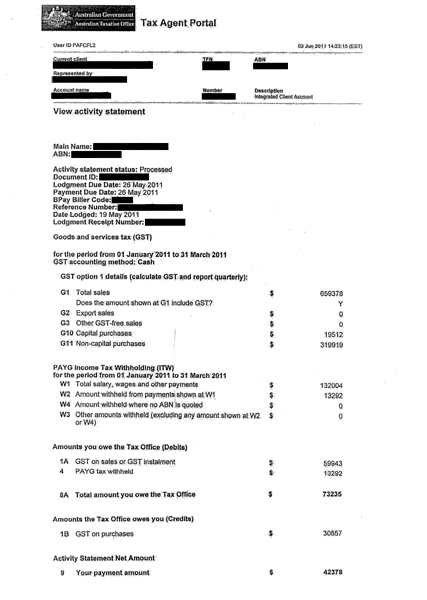

Appendix 2 Example Business Activity Statement Igt

Appendix 2 Example Business Activity Statement Igt

Example Activity Statement Australian Taxation Office

Example Activity Statement Australian Taxation Office

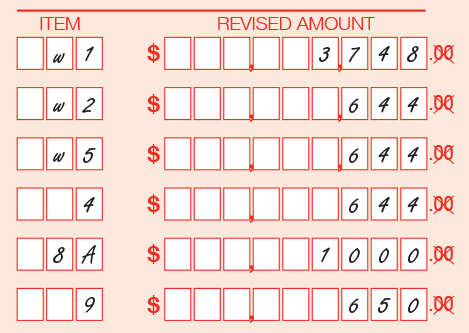

Transferring Values From The Ato Worksheet Onto The Bas

Transferring Values From The Ato Worksheet Onto The Bas

Fake Ato Online Activity Statement Email Links To Malware Hoax Slayer

Low Doc Loan With Business Activity Statements

Low Doc Loan With Business Activity Statements

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

Scotts Chartered Accountants What Is A Business Activity Statement

Scotts Chartered Accountants What Is A Business Activity Statement

Low Doc Loan With Business Activity Statements

Low Doc Loan With Business Activity Statements

Low Doc Loan With Business Activity Statements

Low Doc Loan With Business Activity Statements

Example Activity Statement Australian Taxation Office

Example Activity Statement Australian Taxation Office

Lodging An Activity Statement Through The Business Portal Youtube

Lodging An Activity Statement Through The Business Portal Youtube

Completing Your Bas Australian Taxation Office

Completing Your Bas Australian Taxation Office

Suntax What Is A Business Activity Statement

Suntax What Is A Business Activity Statement

Fake Ato Online Activity Statement Email Links To Malware Hoax Slayer

Fake Ato Online Activity Statement Email Links To Malware Hoax Slayer

Fake Ato Online Activity Statement Email Links To Malware Hoax Slayer

How Do I Complete My Business Activity Statement Youtube

How Do I Complete My Business Activity Statement Youtube

Revising An Earlier Activity Statement Australian Taxation Office

Revising An Earlier Activity Statement Australian Taxation Office