How To Reduce Personal Loan Tenure Hdfc

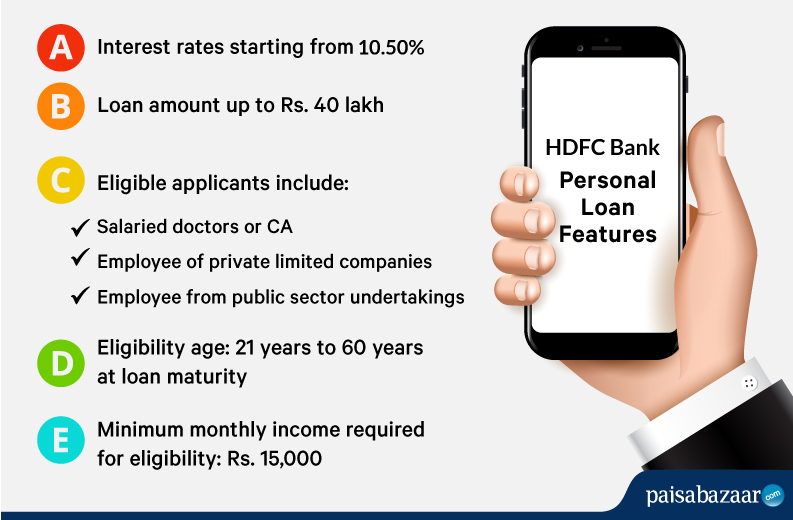

Increasing your EMI amount by 5 every year is definitely a smart choice to reduce your interest repayment burden. 40 lac for a tenure ranging from 12-60 months with easy EMI repayments starting from Rs.

Instant Hdfc Bank Personal Loan 10 75 P A

Instant Hdfc Bank Personal Loan 10 75 P A

Pay back your fast to save paying extra interest.

How to reduce personal loan tenure hdfc. Increasing the interest rate or loan amount will increase your EMI while increasing the tenure will reduce the EMI. Mar 28 2020 You can therefore prepay in parts and reduce the outstanding loan and so do the interest obligations. The same will be sanctioned as per the eligibility of the applicant.

HDFC Bank offers you a Personal Loan that can amount up to Rs. This means a savings in EMI outgo for 15 months 120-105 or Rs. Is this calculator only for HDFC Bank personal loans.

The Tenure applicable to a Personal Loan post the Top Up is from 12 months to 60 months. The bulk payment could reduce the outstanding loan to an extent that you can shorten the tenure to easily accommodate the increased EMI. Here is why HDFC is a household name that Indians proudly reckon with.

Ask your bank for increasing the tenure. Is this calculator only for HDFC Bank personal loans. 3260 lakhs for 10 years and interest rate of 800 you will pay the last EMI in the 105 th month.

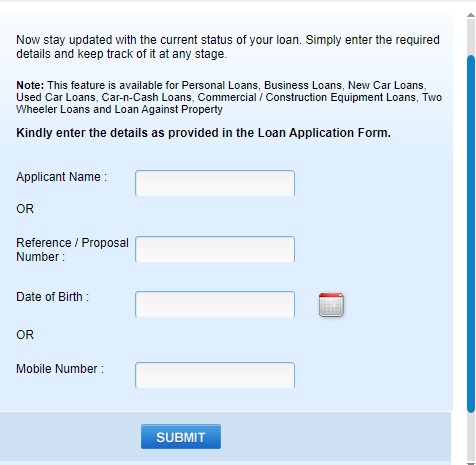

So by this way u can decrease the tenure. Dec 28 2018 Reduce your Loan Tenure. Nov 17 2020 As the COVID-19 moratorium on HDFC personal loans ended in September 2020 from October 2020 onwards regular EMI payments need to be made by borrowers.

Adjust the variables according to your requirement. 51610 you can lessen your loan tenor by 1 year as you will end up repaying your loan sooner and will also save Rs. Keeping in line with the central bank HDFC Bank Loan Restructuring Scheme is available to borrowers with which they can extend their tenure by a maximum of 24 months.

The ability to pay the EMI. But in case the borrower is still unable to start making regular payments at the end of the moratorium period heshe can seek relief by applying for personal loan restructuring mechanism. An efficient loan process makes everything easier when looking for a Personal Loan.

Why should you take a Personal Loan from HDFC Bank. With the HDFC Bank Loan Restructuring Scheme customers can choose to extend their balance tenure to a further period of 24 months that will make their EMIs affordable. HDFC offers you an option to convert your existing adjustable rate to HDFCs current adjustable rate by effectuating a change in the spread as indicated in the loan agreement.

To increase of decrease any of the variables just use the sliders. It does however allow you to make part payment towards your. Adjust the variables according to your requirement.

Sep 04 2019 HDFC Bank does not usually allow complete pre-closure of a personal loan. To increase of decrease any of the variables just use the sliders. This will result in loans getting paid much before giving you more time to add to your retirement funds.

A discounted processing fee is offered for processing of a Personal Loan Top Up from HDFC Bank. When applying for a Balance Transfer of your personal loan to HDFC Bank the tenure of your personal loan can be reworked to suit your ability to pay back the loan. Here in this article we will find out how a pre-existing HDFC Personal Loan consumer can increase the loan tenure.

Jun 12 2019 You get enough flexibility to choose the loan amount tenure and EMI. The additional loan amount sanctioned as Top Up will be combined to form a single loan. Bank look upon the salary and company categorization as per that they give tenure.

With our customised solutions we have fulfilled over 54 million dreams since its inception. The applicant may apply for the desired Tenure. The Maximum tenure allotted is 60 months.

Yes you can ask your bank to increase the loan tenure after the term is started. The following options of conversion are available to an existing customer of HDFC. To reduce your HDFC personal loan interest rate you can choose a longer repayment tenure for your loan pay a higher down payment amount opt for a lower interest rate avail the balance transfer facility or consider your existing bank when taking a loan.

Increasing the interest rate or loan amount will increase your EMI while increasing the tenure will reduce the EMI. If you choose to keep the earlier EMI unchanged Rs. All you have to do is keep paying a marginally higher EMI.

43475 for the principal of Rs. If you keep on paying the first EMI Rs. You are required to submit a written.

The principle balance of the existing Personal Loan. HDFC Bank provides a minimum tenure of 12 months for repayment of a personal loan. 671 lakh on interest cost.

Sep 25 2018 This is an effective trick to reduce your loan tenure and in turn the interest cost. HDFC is a leading provider of Housing Finance in India. Switch To A Lower Interest Rate In The Adjustable Interest Rate Option.

You can align this increase with your. So after loan has been disbursed then if you want to change the tenure you can do part payment as HDFC bank also started with part payment option after 1 year 20 percent of loan amount can be paid.

What Are The Features And Benefits Of Hdfc Bank Personal Loans Daily Bayonet

What Are The Features And Benefits Of Hdfc Bank Personal Loans Daily Bayonet

Best Personal Loan With Lowest Interest Rates Hassle Free Process

Best Personal Loan With Lowest Interest Rates Hassle Free Process

Hdfc Bank Personal Loan Covid 19 Moratorium Emi Period How To Apply Status

Hdfc Bank Personal Loan Covid 19 Moratorium Emi Period How To Apply Status

Hdfc Bank Personal Loan Pre Payment Pre Closure

Hdfc Bank Personal Loan Pre Payment Pre Closure

Hdfc Personal Loan 10 50 Interest Rate Eligibility Apply Online

Hdfc Personal Loan 10 50 Interest Rate Eligibility Apply Online

Hdfc Bank Personal Loan Rate Of Interest 10 50 Iservefinancial

Hdfc Bank Personal Loan Rate Of Interest 10 50 Iservefinancial

Hdfc Personal Loan 10 50 Interest Rate Eligibility Apply Online

Hdfc Personal Loan 10 50 Interest Rate Eligibility Apply Online

Hdfc Bank Insta Jumbo Loan Our Review Emi Calculator

Hdfc Bank Insta Jumbo Loan Our Review Emi Calculator

What Is The Interst Rate On Personal Loan In Hdfc Bank Quora

Personal Loan On Speed The Pre Approved Personal Loan

Personal Loan On Speed The Pre Approved Personal Loan

Personal Loan Everything You Need To Know About Personal Loan Hdfc Bank

Personal Loan Everything You Need To Know About Personal Loan Hdfc Bank

Hdfc Bank Loan Restructuring Offer For Borrowers Here S All That You Need To Know

Hdfc Bank Loan Restructuring Offer For Borrowers Here S All That You Need To Know

Sbi Personal Loan Interest Rates Quikkloan Blog

Sbi Personal Loan Interest Rates Quikkloan Blog

Ways To Increase Your Hdfc Personal Loan Tenure By Mymoneymantra Medium

Ways To Increase Your Hdfc Personal Loan Tenure By Mymoneymantra Medium

5 Top Easy Personal Loan Providers

5 Top Easy Personal Loan Providers

How To Apply For Hdfc Loan Restructuring Online Hdfc Loan Restructuring Link Youtube

How To Apply For Hdfc Loan Restructuring Online Hdfc Loan Restructuring Link Youtube