How To Get 1099 G Online California

You will only get a Form 1099-G if all or part of your SDI benefits are taxable. Did not receive 1099-G or have lost it.

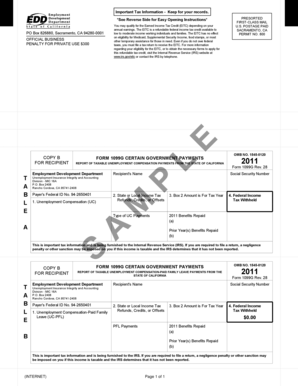

1099 G Fill Online Printable Fillable Blank Pdffiller

1099 G Fill Online Printable Fillable Blank Pdffiller

You may choose one of the two methods below to get your 1099-G tax form.

How to get 1099 g online california. To determine if you are. If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am. You may download a copy of your current IRS Form 1099-G through your online account at desncgov at no charge.

How to Get Your 1099-G online. Select View next to the desired year. How to get 1099-G in California.

Select Account in the top navigation bar. This link will only appear if you received benefits from the EDD for that year. The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021.

If your SDI benefits are taxable and you dont receive your Form 1099-G by mid-February you may call EDD at 800 795-0193 to get another copy. Payment Card and Third Party Network Transactions. Select Request Duplicate to request an official paper copy.

Log in to your MyFTB Account. Information about Form 1099-G Certain Government Payments Info Copy Only including recent updates related forms and instructions on how to file. June 6 2019 447 AM It depends on what type of income is reported on your 1099G Form.

To view and print your statement login below. This income will be included in your federal adjusted gross income which you report to California. Select Print to print your Form 1099G information.

Tax preparation software with a 1099-G. After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at. The 1099-G may automatically populate.

The service is available in many states including New York California New Jersey etc. From payment card transactions eg debit credit or stored-value cards In settlement of third-party payment. For more information see.

To access this form please follow these instructions. Press 2 Other questions about your 1099-G. You will only get a Form 1099-G if all or part.

Here are some situations where you might get a 1099-G and what you should do with it. Besides each online sample is accompanied by detailed instructions. Statements for Recipients of New Jersey Income Tax Refunds Form 1099-G Electronic Services.

Federal state or local governments file Form 1099-G if they made certain payments or if they received Commodity Credit Corporation loan payments. If you are requesting your 1099G to be sent to another address than what we have on file you will be required to submit proof. If you would like to request an additional copy of your 1099-G form to be mailed to your address on file please contact 800 244-5631.

Written requests for a hard copy of your 1099-G form from 2018 2019 2020 or 2021 may be. To access 1099-G electronically youll require your income tax return. Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application.

When tax preparation software is used. But you can find it in the Internet. You will receive a Form 1099G by mail or you can access your Form 1099G information in your UI Online SM account.

Select the Year Issued. You can download it by yourself from the. 1099-Gs for years from 2018 forward are available through your online account.

Pacific time except on state holidays. Please fill out the following form to request a new 1099 form. This way its possible to retrieve the document and print it if necessary.

Go to the department of taxation official website and. You may receive a 1099-K if you received payments. Press 2 Individual.

A 1099-G will be issued for the year the taxpayer receives the refund in this case 2020. Log in to Benefit Programs Online and select UI Online. The G in 1099-G stands for government Your state or local government sends this form to report certain kinds of government payments which may be taxable income to you.

Form 1099-G for New Jersey Income Tax refunds is only accessible online. Follow the prompts to schedule a callback. If you do not have an online account with NYSDOL you may call.

Select FTB-Issued Form 1099 List. We do not mail these forms. A 1099G is issued if you received 10 or more in gross unemployment insurance payments.

If this is a state income tax refund you should be able to access and print this form through the state department of revenue website. As a rule the department sends a tax blank to each recipient. If required the taxpayer reports the refund in year it was received 2020.

You must complete all fields to have your request processed. Do you get 1099 g for disability. To view a copy of Form 1099-G go to MyFTB and use the easy to follow directions.

I did not receive a California Personal Income Tax Refund why did I receive a Form 1099-G. Claimants may also request their 1099-G form via Tele-Serve.

Irs Form 1099 G Software 79 Print 289 Efile 1099 G Software

Irs Form 1099 G Software 79 Print 289 Efile 1099 G Software

1099g Edd Fill Online Printable Fillable Blank Pdffiller

1099g Edd Fill Online Printable Fillable Blank Pdffiller

1099 G 2020 Public Documents 1099 Pro Wiki

1099 G 2020 Public Documents 1099 Pro Wiki

Printable 1099 G Form Get 2020 Blank And Fill It

Printable 1099 G Form Get 2020 Blank And Fill It

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

The Irs 1099 G Form What It Is And Who Receives

The Irs 1099 G Form What It Is And Who Receives

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Ca Edd 1099g Tax Form Update All Zeroes 0 S On 1099g New Edd Phone Line When Will I Get 1099g Youtube

Ca Edd 1099g Tax Form Update All Zeroes 0 S On 1099g New Edd Phone Line When Will I Get 1099g Youtube

Form 1099 G Tax Information Is Available Online San Tan Valley News Info Santanvalley Com

Form 1099 G Tax Information Is Available Online San Tan Valley News Info Santanvalley Com

Printable 1099 G Form Get 2020 Blank And Fill It

Printable 1099 G Form Get 2020 Blank And Fill It

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

1099g Edd Fill Online Printable Fillable Blank Pdffiller

1099g Edd Fill Online Printable Fillable Blank Pdffiller

Https Www Edd Ca Gov Pdf Pub Ctr Form1099g Pdf

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

If We Got From Ca For Paid Family Leave In 2017 But Have Not Received The 1099g Form Yet What Do We Do We Have Contacted The State Many Times With

If We Got From Ca For Paid Family Leave In 2017 But Have Not Received The 1099g Form Yet What Do We Do We Have Contacted The State Many Times With

Unemployment 1099 G Form Page 1 Line 17qq Com

Unemployment 1099 G Form Page 1 Line 17qq Com