How Can I Get My 1099 Form From Unemployment

The New Mexico Department of Workforce Solutions mails all Unemployment Insurance 1099 tax information by the last day of January each year. If you have a 1099 discrepancy call the NMDWS 1099G informational and message line at 505.

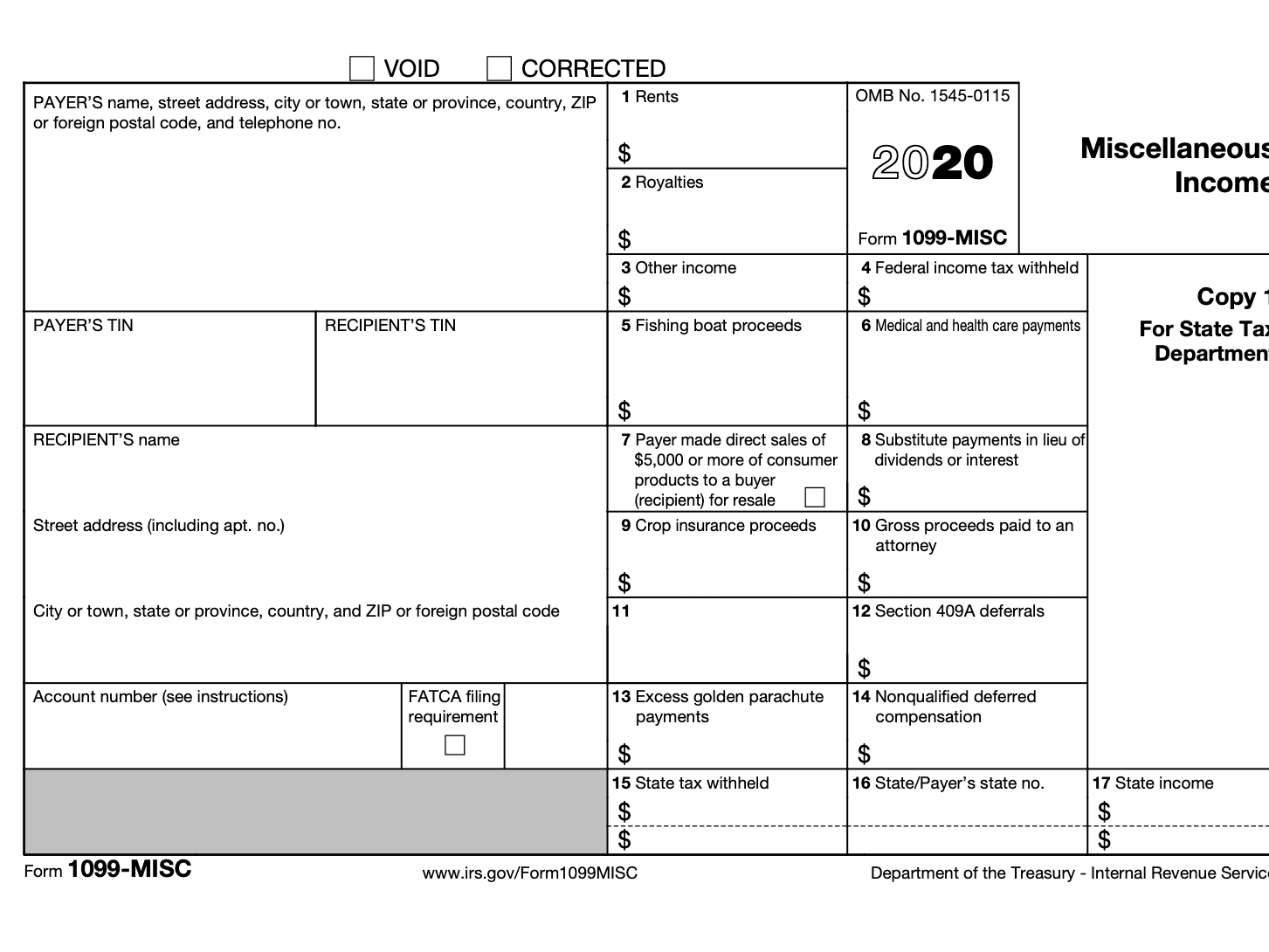

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

This is the fastest method for receiving your tax forms if you selected Electronic as your correspondence type.

How can i get my 1099 form from unemployment. You can also print additional copies if needed. Lost my pandemic unemployment 1099G form and unable to reset password request copy online. Follow the prompts to schedule a callback.

For additional information visit IRS Taxable Unemployment Compensation. The Department of Unemployment Assistance DUA will mail you a copy of your 1099-G by Jan. You can also download your 1099-G income statement from your unemployment benefits portal.

Press 2 Other questions about your 1099-G. Copies will be mailed in late-January to the address on record if you selected US Mail as your correspondence type. Benefits are taxed based on the date the payment was issued.

If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am. These forms will be mailed to the address that DES has on file for you. Will you owe Uncle Sam taxes for your unemployment benefits.

You can log-in to CONNECT and go to My 1099- G in the main menu to view the last five years of your 1099-G Form document. Claimants may also request their 1099-G form via Tele-Serve. The 1099-G tax form is commonly used to report unemployment compensation.

Pacific time except on state holidays. You can opt to receive your 1099-G electronically by providing your consent through the BEACON portal or mobile app. You can access your Form 1099G information in your UI Online SM account.

Remember even if you were unemployed you still have to file income taxes. The most common use of the 1099-G is to report unemployment compensation as well as any state or local income tax refunds you received that year. I cant file my taxes until I get my 1099 G form and cant get any help to resolve this matter.

Unemployment is taxable income. If you would like to request an additional copy of your 1099-G form to be mailed to your address on file please contact 800 244-5631. Myunemploymentwisconsingov Log on using your username and password then go to the Unemployment Services menu to access your 1099-G tax forms.

The 1099-G is an IRS form that shows the total unemployment benefits you received and any taxes withheld during the previous calendar year. We will mail you a paper Form 1099G if you. The fastest way to receive a copy of your 1099-G Form is by selecting electronic as your preferred method for correspondence.

Look for the 1099-G form youll be getting online or in the mail. Press 2 Individual. After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile.

By January 31 all 1099-Gs will be mailed out to individuals who had claimed Unemployment Insurance UI benefits in the previous calendar year. Individuals can access copies of 1099 forms by logging into the UI Tax Claims System wwwjobsstatenmus Sunday through Friday from 400 am. You must update your mailing address by updating your personal information in the BEACON portal on the Maryland Unemployment Insurance for Claimants mobile app or by contacting a Claims Agent at 667-207-6520.

31 of the year after you collected benefits. Ask Your Own Tax Question. To view and print your current or previous year 1099-G tax forms online logon to the online benefits services website.

For Pandemic Unemployment Assistance PUA claimants the. You can access your Form 1099G information on your Correspondence page in Uplink account. You will need this information when you file your tax return.

They are available year-round for the last 5 years. Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application. Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form.

Form 1099G is now available in Uplink for the most recent tax year. In addition to receiving a hard copy in the mail in January you will be able to log into the UI Tax Claims System and view your 1099G. You can receive a copy of your 1099-G Form multiple ways.

Please keep your address updated in CONNECT. Instructions for the form can be found on the IRS website.

Detr Advises And Encourages Claimants Regarding 1099 G Forms

Detr Advises And Encourages Claimants Regarding 1099 G Forms

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received Cbs Pittsburgh

Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received Cbs Pittsburgh

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg) Reporting 1099 Misc Box 3 Payments

Reporting 1099 Misc Box 3 Payments

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

1099 Tax Forms Available Soon For Pa Unemployment Claimants Erie News Now Wicu And Wsee In Erie Pa

1099 Tax Forms Available Soon For Pa Unemployment Claimants Erie News Now Wicu And Wsee In Erie Pa

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes