Where Do I Find My 1099-r Form

We make the last 5 years available to you. You can find the below information on 1099 R tax form.

Early 2019 Important Retiree Tax Reminders Teachers Retirement System Of The State Of Illinois

Early 2019 Important Retiree Tax Reminders Teachers Retirement System Of The State Of Illinois

I filed my 1040 yesterday but forgot to include my 1099 R.

Where do i find my 1099-r form. A 1099-R is an IRS information form that reports potentially taxable distributions from certain types of accounts many of which are retirement savings accounts. Form 1099R is a tax information form youll receive if youve taken a distribution from a retirement plan. You can also call them and request that they send a copy of your Form 1099-R at 888 767-6738.

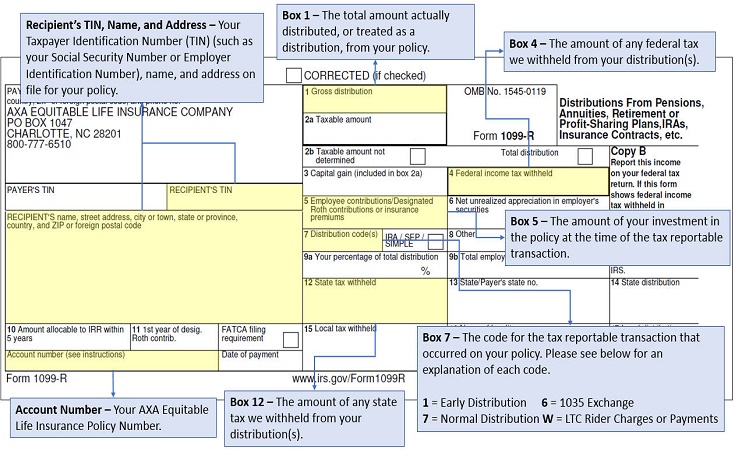

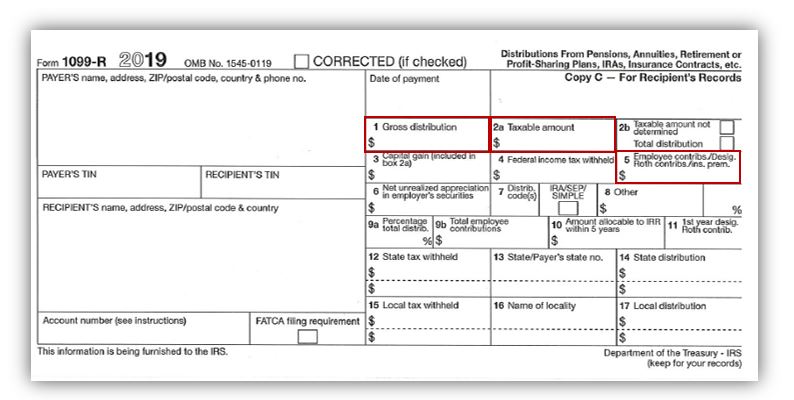

Regarding 1099-R distribution codes retirement account distributions on Form 1099-R Box 7 Code 4. Qualified plans and section 403b plans. Annuities pensions insurance contracts survivor.

What does your 1099 R show. Any individual retirement arrangements IRAs. See the instructions for Form 1040 or 1040NR.

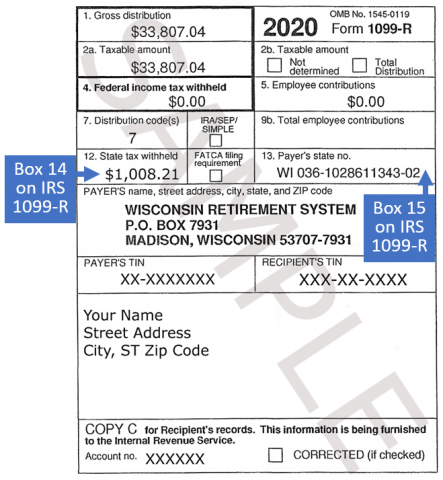

No beginning with tax year 2015 if the 1099-R shows NYS NYC or Yonkers tax withheld you must copy the required information from federal Form 1099-R onto the New York State Form IT-1099-R Summary of Federal Form 1099-R Statements and submit it with your return. File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from. You should receive a copy of Form 1099-R or some variation if you received a distribution of 10 or more from your retirement plan.

No need to wait on the phone use a computer or speak to anyone. The IRS requires the custodian of the plan issuing you the distribution to forward a copy. You will also be able to access your 1099-R Form for the three years prior to the tax year that just ended.

I hope this guide on Form 1099-R has helped you learn more about it and equipped you with the knowledge youll need in. View a statement describing your annuity payment. The plan or account custodian completing the 1099-R must fill out three copies of every 1099-R they issue.

Select a year from the dropdown menu to view tax forms from other years. However it wasnt paid to the person until after death. When using self-service systems you need your claim number Personal Identification Number PIN and social security number.

Telephone self service requests. MyPay is your fastest and most secure option to obtain a copy of your 1099R and to manage your retirement account every day. Follow the prompts to access your 1099-R Form for the tax year that just ended.

There is some detailed information on this that will need to be entered in TurboTax so wait to get it before you enter in TurboTax. Click 1099-R Tax Form in the menu to view your most recent tax form. Get your 1099R right away.

What is a 1099-R. The 1099R form is issued to you each year by who is paying the retirement income to you. Do not also send in federal Form 1099-R.

Also while your plan holder issuer or manager would be responsible for Form 1099-R it never hurts to check if there are any discrepancies to minimize any issues with the IRS. The total amount of your monthly gross benefit. Variations of Form 1099-R include.

The main purpose of filing 1099 R Form is to report death benefit payments made by employers that are not made as a part of a pension. Most public and private pension plans that are not part of the Civil Service system use the standard Form 1099-R. Login to myPay and print your 1099R out in the comfort of your own home.

Profit-sharing or retirement plans. Youll report amounts from Form 1099-R as income. This may delay processing of your return.

Keep it for your records. You can also call our toll-free number 1 888 767-6738 for these and many of your voluntary withholdings. - Answered by a verified Tax Professional.

This is because its income in respect of a decedent. Click 1099-R Summary under My Payroll Information. How can I fix this error.

Not a myPay user yet. Click the save or print icon to download or. Form CSA 1099R Form CSF 1099R and.

Once you do youll also have the option to sign up for paperless 1099-Rs going forward which you can download at any time. There are many varieties including 1099-INT for interest 1099-DIV for dividends 1099-G for tax refunds 1099-R for pensions and 1099-MISC for. You can download your Form 1099-R by logging into your account online.

Insurance contracts etc are reported to recipients on Form 1099-R. Youll generally receive one for distributions of 10 or more. If your annuity starting date is after 1997 you must use the simplified method to figure your taxable amount if your payer didnt show the taxable amount in box 2a.

To view your most recent 1099-R just log in below or click register to set up your account online. We use cookies to give you the best possible experience on our website. Total amount of federal and state tax withheld during the year.

So the income is taxable to the recipient in the year received. How to access your 1099-R tax form Sign in to your online account. Income in respect of a decedent is earned by a deceased person before death.

Self Employed Medicare Retiree Box 5 On 1099 R Is Empty Is Health Insurance Deductible 1040 Line 29 Personal Finance Money Stack Exchange

Self Employed Medicare Retiree Box 5 On 1099 R Is Empty Is Health Insurance Deductible 1040 Line 29 Personal Finance Money Stack Exchange

Formulario 1099 R Instrucciones E Informacion Sobre El Formulario De Impuestos 1099 R

Formulario 1099 R Instrucciones E Informacion Sobre El Formulario De Impuestos 1099 R

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Understanding Your 1099 R Form Kcpsrs

Understanding Your 1099 R Form Kcpsrs

Opers Tax Guide For Benefit Recipients

Opers Tax Guide For Benefit Recipients

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

What Does Fatca Mean And Where Is It On My 1099r F

What Does Fatca Mean And Where Is It On My 1099r F

2018 Forms 5498 1099 R Come With A Few New Requirements Ascensus

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Etf 1099 R Form Box Number Correction Etf

Etf 1099 R Form Box Number Correction Etf

Solved Where Do I Enter The Information From My 1099 R In Turbotax

Solved Where Do I Enter The Information From My 1099 R In Turbotax

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance