Do I Need To Report 1099 R On My Tax Return

Just keep it for your records. Whether federal income tax was withheld from the distribution Form 1099-R.

Staple it to the front on your return.

Do i need to report 1099 r on my tax return. Even though you arent required to pay tax on this type of activity you still must report it to the Internal Revenue Service. Reporting your rollover is relatively quick and easy all you need is. Remember this is an information return and not necessarily an income tax return.

You should receive a copy of Form 1099-R or some variation if you received a distribution of 10 or more from your retirement plan. Distributions from the annuity on Form 1099-R. However you do not need to file Form 1099-R to report the surrender of.

The tool is designed for taxpayers who were US. Its possible to receive a 1099-R if youre not retired especially if you took a distribution from a retirement account during the tax year. Not all income earned on Form 1099-R is going to be reported on your federal income tax return though.

If you have received multiple 1099-R forms youll need to combine some of the information to complete your tax forms. You must report the income on your personal tax return and you must pay both income tax and self-employment tax Social SecurityMedicare on this income. If you are efiling your return you do not send the 1099-R.

This means you may have only one big taxable income for a year and no longer need a 1099-R. The federal tax filing deadline for individuals has been extended to. This may delay processing of your return.

Open continue return if you dont already have it open. Also note that some annuities pay retirement income in a single lump sum. If married the spouse must also have been a.

The following applies to 2017 IRS forms. Unlike Forms W-2 you dont file Forms 1099 with your return. This is the most basics of filing a federal income tax return.

IRS Form 1099-R reports all of the distributions youve taken from your IRA or 401k retirement accounts during a calendar year whether or not those amounts are taxable. Youll get a 1099-R if you received 10 or more from a retirement plan. For more information on reporting Form-1099-R refer to Publication 575 Pension and Annuity Income.

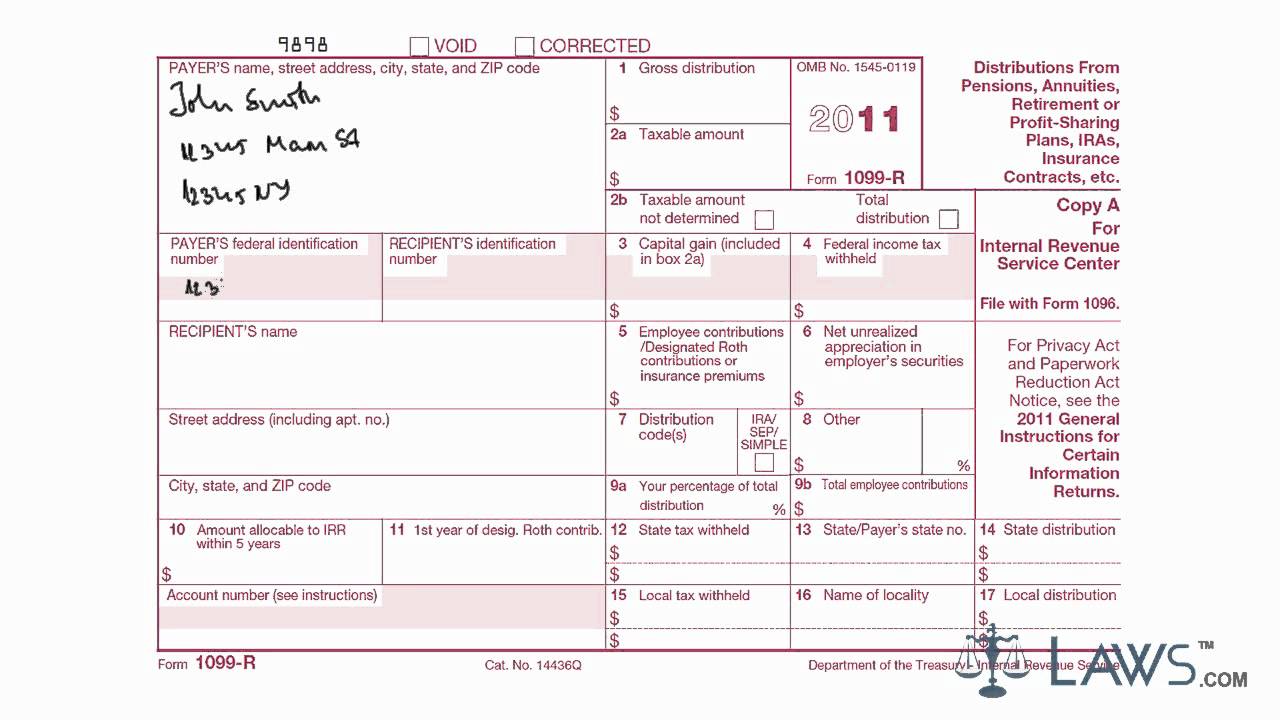

When you prepare a federal income tax return the income you earned must be reported on it and the tax forms that report the income earned must be attached to 1040. If you are filing on paper by mail attach the 1099-R to your Federal income tax return only if there is an entry in Box 4 for Federal income tax withheld. Form 1099-R is used to report the distribution of retirement benefits such as pensions and annuities.

See Charitable gift annuities later. Form RRB-1099-R or Form RRB-1099 are the equivalent of receiving Form 1099-R and Form 1099. This is because its income in respect of a decedent.

You need Forms 1099 that report dividends and stock proceeds that you might not otherwise know about. Income in respect of a decedent is earned by a deceased person before death. Youll report amounts from Form 1099-R as income.

Heres how to enter your 1099-R in TurboTax. Add up all of the box 1 amounts if you have multiple forms and report the total on Form 1040 box 15a or box 16a depending on whether youre reporting a taxable distribution from IRAs. Also if your income is solely from Social Security you dont need to get a 1099-R tax form.

Form 1099-MISC is now bused to report other types of payments. Inside TurboTax search for 1099-R and select the Jump to link in the search results. All distributions must be reported and a taxable amount calculated which is then entered on.

No beginning with tax year 2015 if the 1099-R shows NYS NYC or Yonkers tax withheld you must copy the required information from federal Form 1099-R onto the New York State Form IT-1099-R Summary of Federal Form 1099-R Statements and submit it with your return. The IRS requires the custodian of the plan issuing you the distribution to forward a copy. Forms 1040 and 1040A have not yet been published for 2018.

If you receive an IRS Form 1099-R the information on it must be transferred to your tax return before you file it. Life insurance annuity and endowment contracts. Report payments of matured or redeemed annuity endowment and life insurance contracts.

Do not also send in federal Form 1099-R. Citizens or resident aliens for the entire tax year for which theyre inquiring. For 2020 taxes and beyond Form 1099-NEC now must be used to report payments to non-employees including independent contractors.

Keep it for your records. However it wasnt paid to the person until after death. Youll be filing a Form 1040 or Form 1040A because Form 1040EZ does not have a place to enter 1099-R information.

The information grayed out on the entry screen may be reported to you but is not necessary in the calculation of your income tax. Form 1099R is a tax information form youll receive if youve taken a distribution from a retirement plan. You do need to report all retirement-account distributions on your federal tax return even if theyre tax-free rollovers.

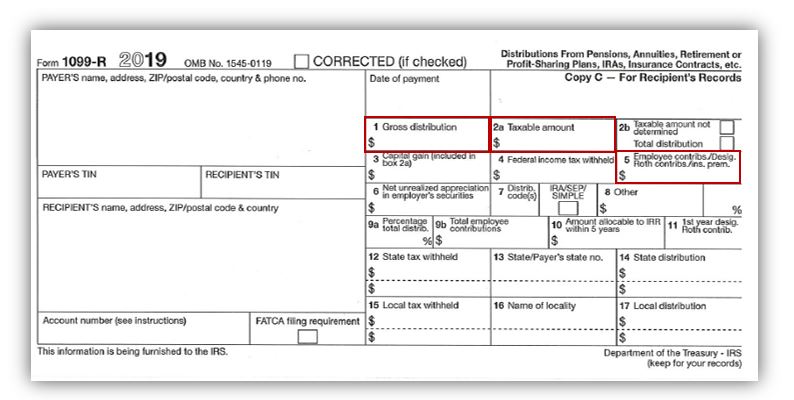

For example Form 1099-R box 1 shows the gross distribution from your plan.

Understanding Your 2018 1099 R Kcpsrs

Understanding Your 2018 1099 R Kcpsrs

2018 Forms 5498 1099 R Come With A Few New Requirements Ascensus

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

Understanding Your 1099 R Form Kcpsrs

Understanding Your 1099 R Form Kcpsrs

Early 2019 Important Retiree Tax Reminders Teachers Retirement System Of The State Of Illinois

Early 2019 Important Retiree Tax Reminders Teachers Retirement System Of The State Of Illinois

Understanding Your 1099 R Form Kcpsrs

Understanding Your 1099 R Form Kcpsrs

Irs Form 1099 R Box 7 Distribution Codes Ascensus

1099 R Form Copy C Recipient Discount Tax Forms

1099 R Form Copy C Recipient Discount Tax Forms

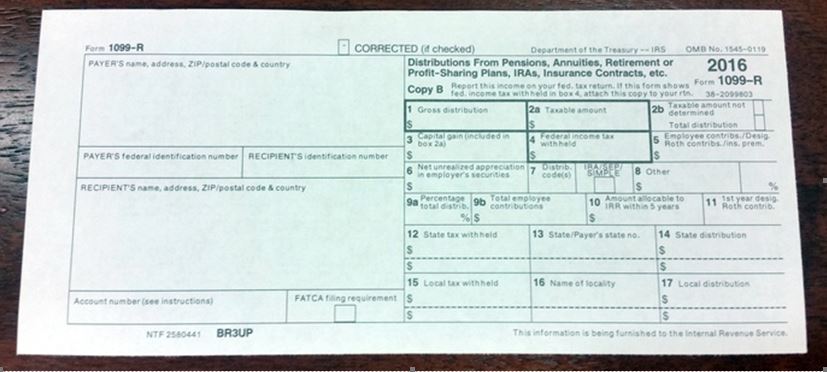

What Does Fatca Mean And Where Is It On My 1099r F

What Does Fatca Mean And Where Is It On My 1099r F

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Solved Where Do I Enter The Information From My 1099 R In Turbotax

Solved Where Do I Enter The Information From My 1099 R In Turbotax

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

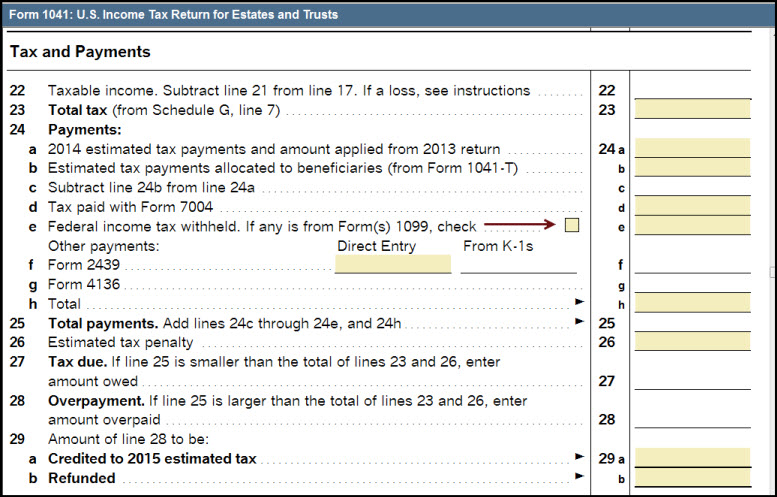

Reporting Income And Withholding From A 1099 R Rec Intuit Accountants Community

Reporting Income And Withholding From A 1099 R Rec Intuit Accountants Community

Everything You Need To Know About Irs 1099 R Pdffiller Blog

Everything You Need To Know About Irs 1099 R Pdffiller Blog

Opers Tax Guide For Benefit Recipients

Opers Tax Guide For Benefit Recipients

Tax Form Focus Irs Form 1099 R Strata Trust Company

Tax Form Focus Irs Form 1099 R Strata Trust Company