Dividend Declaration Rules Under Companies Act 2013

Where in simple words dividend can be defined as the sum of money paid by a company to its shareholders out of the profits made by a company if so authorised by its articles in proportion to the amount paid- up on each share held by them. Dividend Section 2 35 of Companies Act 2013 Act for short defines the term as including any interim dividend.

Pin On Indian Companies Act 2013

Pin On Indian Companies Act 2013

When the dividend has been declared by the company but has not been claimed by the shareholder within thirty days then within 7 days of expiry of period of 30 days that is within 30-37 days of the declaration the company has to transfer the unpaid amount to the special account in the bank known as Unpaid Dividend Account.

Dividend declaration rules under companies act 2013. The rate of dividend is not fixed it depends on the profitability of the company. In pursuant to subsection 3 of section 123 of Companies Act 2013 and relevant rules made thereunder a dividend is said to be an Interim dividend if it is declared by the board of directors during any financial year or at any time during the period from the closure of financial year till holding of the annual general meeting. The Dividend is paid as per provisions of companies act 2013 and companies declaration and payment of dividend rules 2014.

30092020 up to 04102020. Section 123 of the Companies Act 2013 provides that dividend should be declared by the company on such rate at its annual general meeting as recommended by the board. Year any company proposes to declare dividend out of the accumulated profits earned by it in previous years and transferred by the company to the reserves such declaration of dividend shall not be made except in accordance with such rules as may be prescribed in this behalf.

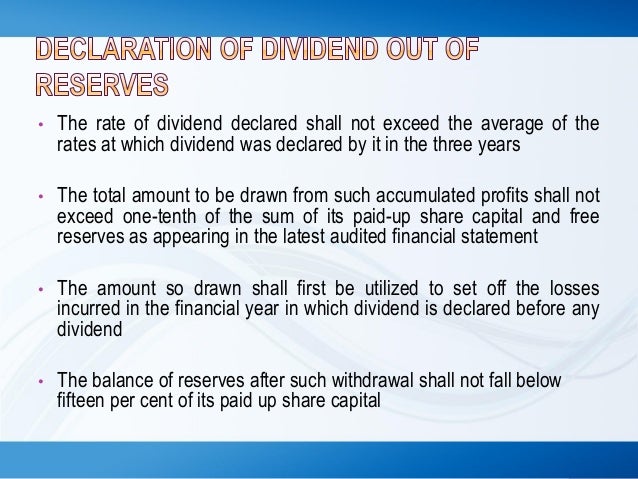

81 For the purposes of second proviso to sub-section 1 of section 123 a company may declare dividend out of the accumulated profits earned by it. Section 123 of Companies Act 2013 Declaration of Dividend. Section 51 Under the Companies Act 2013 hereinafter referred to as CA ACT 2013 Section 123 to 127 of Chapter VIII deals with the.

AS PER COMPANIES ACT 2013 The company is required to deposit the amount of dividend so declared within 5 days from the date of declaration of Dividend ie. 52 rows Chapter VI The Companies Registration of Charges Rules 2014. Companies licensed under Section 8 of the Companies Act 2013 or corresponding provisions of any previous enactment thereof are prohibited by their constitution from paying any Dividend to its Members.

Transfer of unclaimed dividend. The amount of dividend approved by the board cannot be exceeded by the company. This sub-rule shall not apply to a company which has not declared any dividend in each of the three preceding financial year.

Dividend is generally defined as a pro-rata share in an amount to be distributed or a sum of money paid to the shareholders of a corporation out of its earnings. Clause 35 of section 2 of the Companies Act 2013 the Act defines dividend as dividend includes any interim dividend. Therefore all provisions under Chapter VIII of the Act and under the Companies Declaration and Payment of Dividend.

1 The rate of dividend declared shall not exceed the average of the rates at which dividend was declared by it in the three years immediately preceding that year. 22 rows Article explains statutory provisions related to Declaration and payment of. It can be paid annually once or during the year.

Once the dividend is declared it shall be debt that must be paid by the company to its shareholders. According to the provisions of Companies Act - 2013 No dividend shall be payable except by way of cash where dividend payable in cash can also be paid through cheque warrant or in any electronic mode to the shareholder who is entitled to the dividend. 5 No company shall declare dividend unless carried over previous losses and depreciation not provided in previous year are set off against profit of the company of the current year the loss or depreciation whichever is less in previous years is set off against the profit of the company for the year for which dividend is declared or paid.

If the company defaults on transferring the amount to unpaid dividend account within specified time period the company. No exact definition has been given in the Act. A out of the profits of the company for that year arrived at after providing for depreciation in accordance with the provisions of sub-section 2 or out of the profits of the company for any previous financial year.

Draft Rules under Companies Act 2013 CHAPTER VIII DECLARATION AND PAYMENT OF DIVIDEND Declaration of dividend out of reserves. It is paid to shareholder for their investment in shares of company. Rule 1 to 12.

Provided that in case the company has incurred loss during the current financial year up to the end of the quarter immediately preceding the date of declaration of interim dividend such interim dividend shall not be declared at a rate higher than the average dividends declared by the company during immediately preceding three financial years. 1 No dividend shall be declared or paid by a company for any financial year except.

Companies Act 2013 Financial Statement Board Report

Companies Act 2013 Financial Statement Board Report

Declaration And Payment Of Dividend Companies Act 2013

Declaration And Payment Of Dividend Companies Act 2013

Appointment Of Directors Under Companies Act 2013 In India

Appointment Of Directors Under Companies Act 2013 In India

What Is A Company Under The Companies Act

What Is A Company Under The Companies Act

Dividends Audit And Accounts Under The Companies Act 2013 Ipleaders

Dividends Audit And Accounts Under The Companies Act 2013 Ipleaders

Procedure For Declaration Of Interim Dividend Lawrbit

Procedure For Declaration Of Interim Dividend Lawrbit

Format Of Moa And Aoa Of Section 8 Company Due Diligence Financial Services Aoa Company Format

Format Of Moa And Aoa Of Section 8 Company Due Diligence Financial Services Aoa Company Format

Govt Guidelines To Clarify Arm S Length Ordinary Course Of Business Definitions Business Standard News

Govt Guidelines To Clarify Arm S Length Ordinary Course Of Business Definitions Business Standard News

Dividend And Payment Of Dividends Under Companies Act 2013 Law Times Journal

Declaration And Payment Of Dividend Companies Act 2013

Declaration And Payment Of Dividend Companies Act 2013

Declaration Of Dividend Under Companies Act 2013

Declaration Of Dividend Under Companies Act 2013

Company Meetings As Per Companies Act Ppt Video Online Download

Company Meetings As Per Companies Act Ppt Video Online Download

Procedure For Conducting Audit Committee Meeting Lawrbit

Procedure For Conducting Audit Committee Meeting Lawrbit

Declaration And Payment Of Dividend Under Companies Act 2013

Declaration And Payment Of Dividend Under Companies Act 2013

Shares With Superior Voting Rights M A Critique

Shares With Superior Voting Rights M A Critique

Declaration And Payment Of Dividend Companies Act 2013

Declaration And Payment Of Dividend Companies Act 2013

Dormant Company In 2020 Acting Company Investing

Dormant Company In 2020 Acting Company Investing

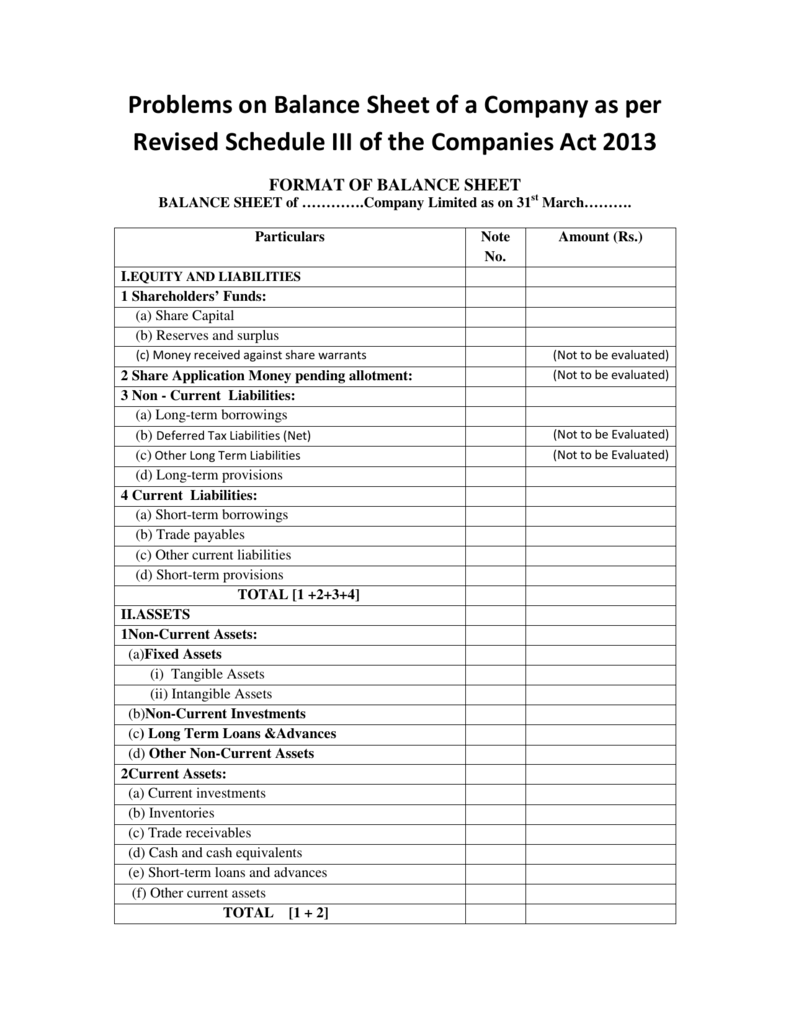

Problems On Balance Sheet Of A Company As Per Revised Schedule

Problems On Balance Sheet Of A Company As Per Revised Schedule

Balance Sheet Profit And Loss Account Under Companies Act 2013 Accounting Taxation Balance Sheet Accounting Profit

Balance Sheet Profit And Loss Account Under Companies Act 2013 Accounting Taxation Balance Sheet Accounting Profit