Where Can I Find My 1099 R Form

Get your 1099R right away. This may delay processing of your return.

You can find the below information on 1099 R tax form.

Where can i find my 1099 r form. How do I obtain a 1099 form from VA. No need to wait on the phone use a computer or speak to anyone. Well send your tax form to the address we have on file.

You may also receive Forms SSA-1099 RRB-1099 or RRB-1099-R from the Social Security Administration or Railroad Retirement Board to report the benefits you received during the year. Need a replacement copy of your SSA-1099 or SSA-1042S also known as a Benefit Statement. Please note in accordance with a program piloted by Internal Revenue Service IRS only the last four digits of your Social Security number will be displayed and the first five digits will appear as Xs.

Now you can get a copy of your 1099 anytime and anywhere you want using our online services. The main purpose of filing 1099 R Form is to report death benefit payments made by employers that are not made as a part of a pension. If you need a statement of benefits paid please contact your VA Regional Office.

You can verify or change your mailing address by clicking on Profile in the. If you need to report the information in your 1099-R as income when you prepare your tax return youll need to gather all of your 1099-Rs. Social Security Number SSN 123-45-6789 will appear as XXX-XX-6789.

Do not also send in federal Form 1099-R. MyPay is your fastest and most secure option to obtain a copy of your 1099R and to manage your retirement account every day. You can also call them and request that they send a copy of your Form 1099-R at 888 767-6738.

Not a myPay user yet. No beginning with tax year 2015 if the 1099-R shows NYS NYC or Yonkers tax withheld you must copy the required information from federal Form 1099-R onto the New York State Form IT-1099-R Summary of Federal Form 1099-R Statements and submit it with your return. The IRS and all other applicable copies of the form visit wwwIRSgovorderforms.

Youll then need to enter the information into the correct box on Form 1040. How do I obtain a 1099 form from VA for tax purposes. - Answered by a verified Tax Professional.

There is some detailed information on this that will need to be entered in TurboTax so wait to get it before you enter in TurboTax. The 1099R form is issued to you each year by who is paying the retirement income to you. Answers others found helpful.

What does your 1099 R show. Social security benefits and equivalent railroad retirement benefits are reported on Form 1040 lines 6a and 6b. It shows the total amount of benefits you received from Social Security in the previous year.

How can I fix this error. Sign in to your account click on Documents in the menu and then click the 1099-R tile. VA benefits are not taxable.

All Revisions for Form 1099-R and Instructions. How to request your 1099-R tax form by mail. We use cookies to give you the best possible experience on our website.

Therefore VA does not send out 1099 forms. Login to myPay and print your 1099R out in the comfort of your own home. A Social Security 1099 is a tax form Social Security mails each year in January to people who receive Social Security benefits.

Keep it for your records. They indicate this on their website as well. I just wanted to let you know this is the correct number but it isnt working right now because they are experiencing high call volume.

You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account. Telephone self service requests. Click on Employer and Information Returns and well mail you the forms you request and their.

If you are looking for 1099s from earlier years you can contact the IRS and order a wage and income transcript. Total the amounts on Box 1 of all the forms. Federal 1099-R tax forms are mailed by January 31.

The total amount of your monthly gross benefit. An alternative to asking an issuer for a Form 1099 is to get a transcript of your account from the IRS. It should show all Forms 1099 issued under your Social Security number.

Get a copy of your Social Security 1099 SSA-1099 tax form online. A 1099R is a tax form you receive when you take a distribution from a pension IRA or another retirement account. If you got a distribution from a Wells Fargo account of that type they should send you the form in the mail and it may be available online as well.

I filed my 1040 yesterday but forgot to include my 1099 R. Online Ordering for Information Returns and Employer Returns. How to Get a.

The transcript should include all of the income that you had as long as it was reported to the IRS. All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS. Publication 1220 PDF Specifications for Filing Forms 10971098 1099 3921 3922 5498 8935and W2-G Electronically PDF Additional Publications You May Find Useful.

Total amount of federal and state tax withheld during the year. The Benefit Statement is also known as the SSA-1099 or the SSA-1042S.

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

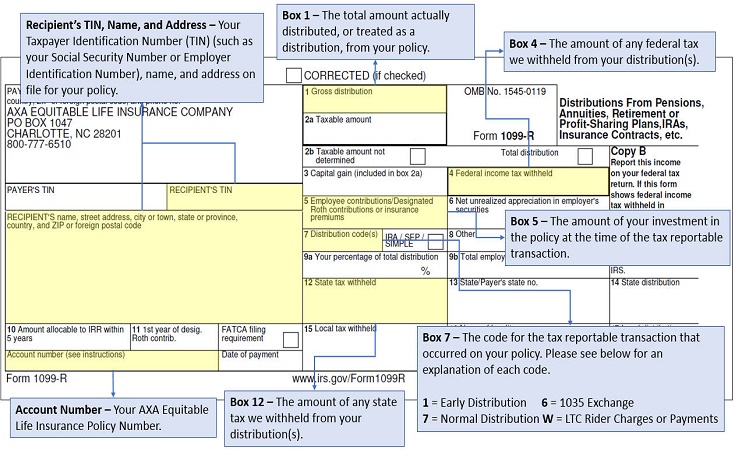

What Does Fatca Mean And Where Is It On My 1099r F

What Does Fatca Mean And Where Is It On My 1099r F

2018 Forms 5498 1099 R Come With A Few New Requirements Ascensus

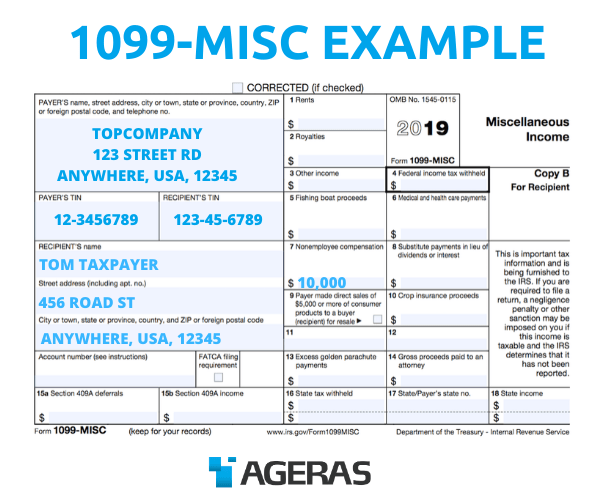

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Opers Tax Guide For Benefit Recipients

Opers Tax Guide For Benefit Recipients

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Missing An Irs Form 1099 Don T Ask For It

Missing An Irs Form 1099 Don T Ask For It

Solved Where Do I Enter The Information From My 1099 R In Turbotax

Solved Where Do I Enter The Information From My 1099 R In Turbotax

Self Employed Medicare Retiree Box 5 On 1099 R Is Empty Is Health Insurance Deductible 1040 Line 29 Personal Finance Money Stack Exchange

Self Employed Medicare Retiree Box 5 On 1099 R Is Empty Is Health Insurance Deductible 1040 Line 29 Personal Finance Money Stack Exchange

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Early 2019 Important Retiree Tax Reminders Teachers Retirement System Of The State Of Illinois

Early 2019 Important Retiree Tax Reminders Teachers Retirement System Of The State Of Illinois

How To Read Your 1099 Robinhood

How To Read Your 1099 Robinhood