Do I Have To Send A 1099 To Every Vendor

This requirement applies to persons who in the course of a business sell consumer. Hi we missed sending a 1099 to a vendor do we have to send in the entire batch again or just amend the 1096 with the additional 1099.

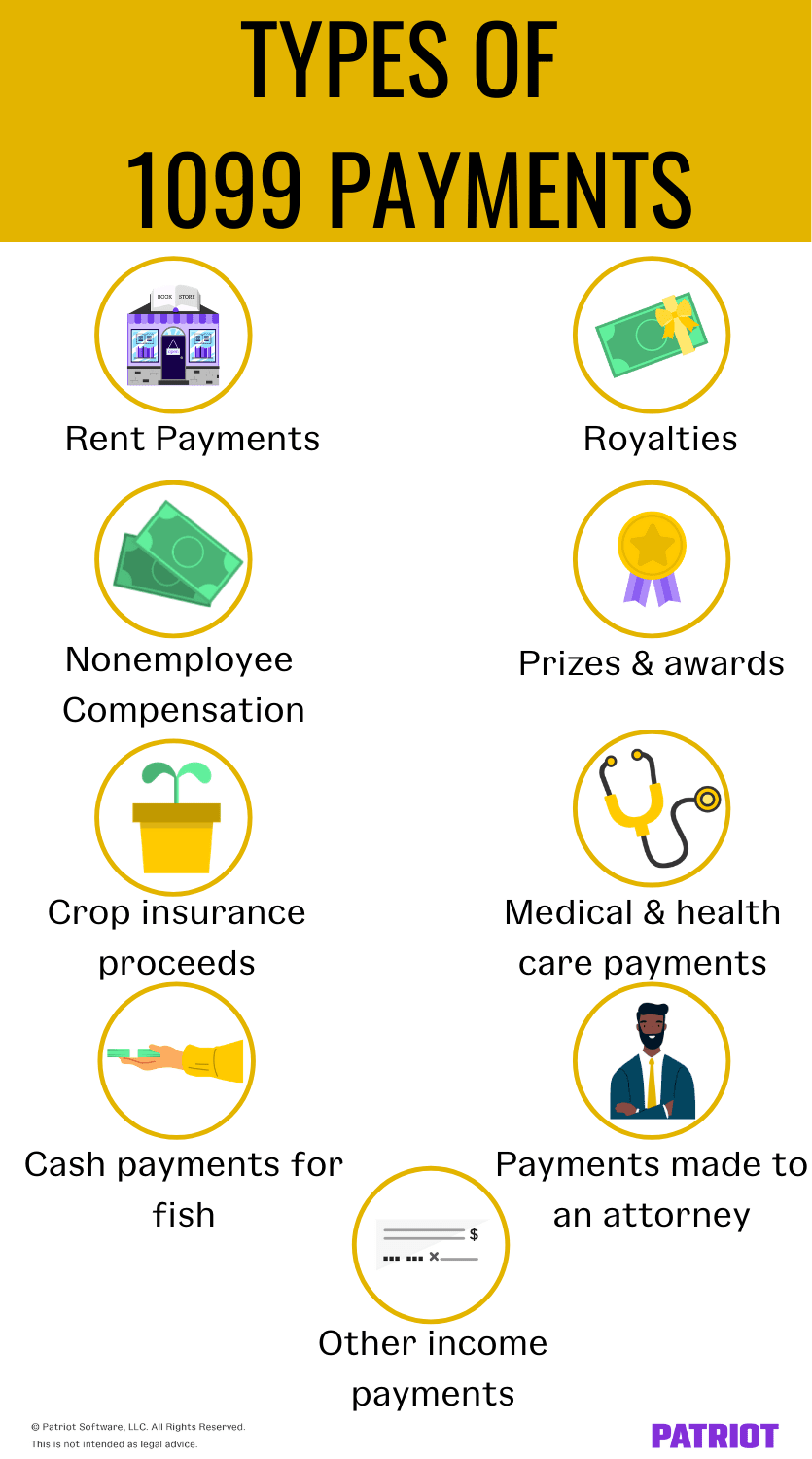

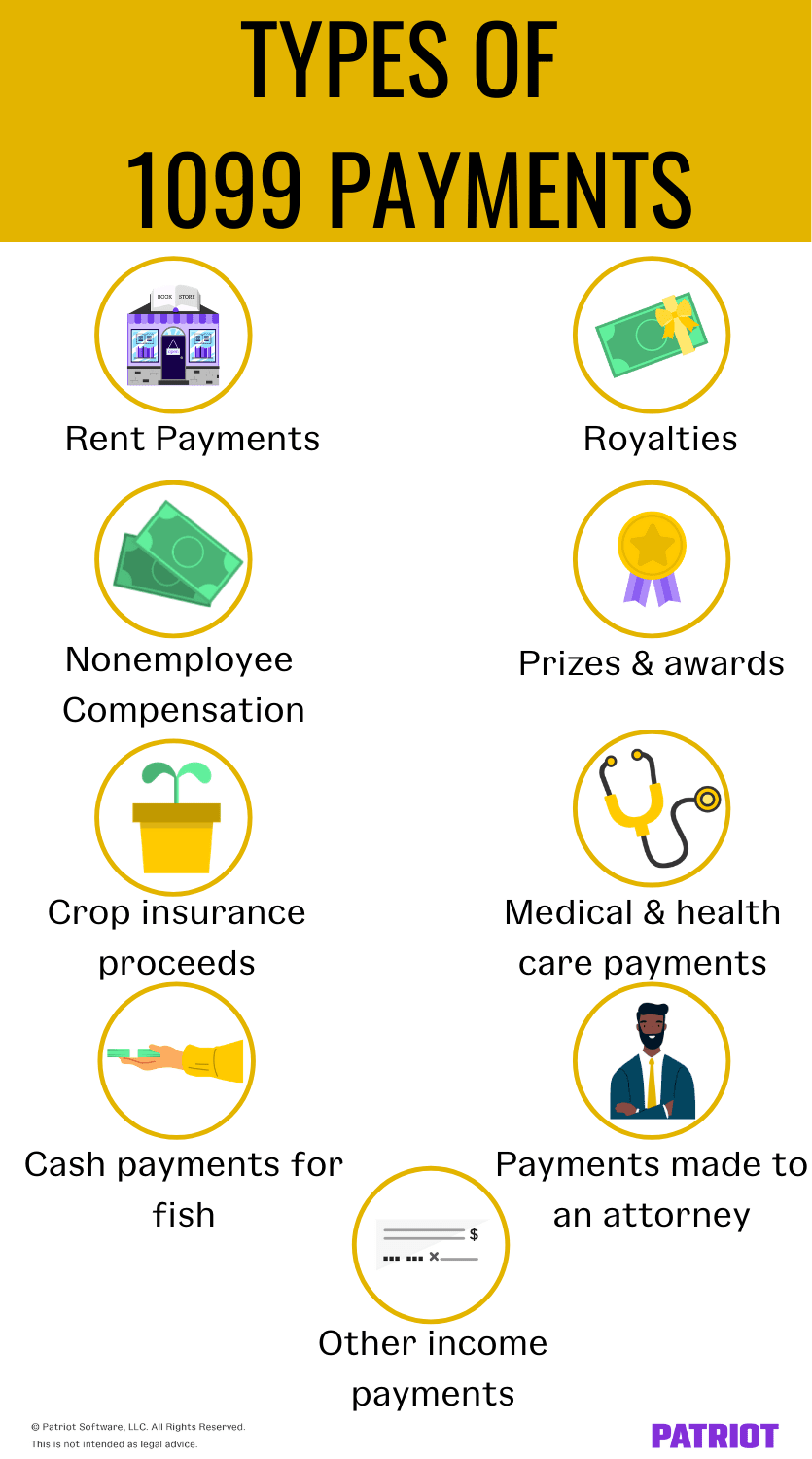

1099 Payments How To Report Payments To 1099 Vendors

1099 Payments How To Report Payments To 1099 Vendors

Please tell me more so we can help you best.

Do i have to send a 1099 to every vendor. You need to file Form 1099-MISC only if you pay an independent contractor 600 or more by cash check or direct deposit during the year. What is a 1099. Dont hesitate to get a hold of me if you have.

You will need to provide a 1099 to any vendor who is a. It would be a 1099-Misc. Use Form 1099-MISC to report how much you paid in miscellaneous income.

Similar to a W-2 a 1099-Misc is a tax form showing how much was paid to a vendor or subcontractor throughout the year. If the 1099 E-File doesnt let you make corrections after its been e-filed. Using this as a normal business practice will give you the vendors mailing information Tax ID number and also require that the vendor indicate if it is a corporation or not.

I was told that I have to get a 1099 for every vendor that I work for that is a llc or not a corporation. For each 1099 vendor you pay at least 600 to you must complete and file Form 1099-MISC Miscellaneous Income. Vendors who operate as C- or S-Corporations do not require a 1099.

Direct Sales The law requires information reporting on Form 1099 MISC for certain direct sellers. You are not required to send 1099s to S-Corporations or C-Corporations. A 1099-Misc is an IRS form required to be completed and sent to non-employees no later than January 31 2020.

However be sure to get a Form W-9 filled out by the vendor before making the first payment. The Accountant will know how to help. If you paid a vendor more than 10 in interest youve got to send out a 1099-INT.

The general rule is that business owners must issue a Form 1099-NEC to each person to whom they have paid at least 600 in rents services including parts and materials prizes and awards or other income payments. A best practice is to collect information from your vendor by having them fill out Form W-9 whether you think they need a 1099 or not. We strongly recommend that you obtain a W-9 from every vendor that provides you services that could require a 1099 before you pay them.

If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. You need to send 1099s to the people whose work you sold IF you sold more than 60000 for that person in the year. If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099.

Make sure that you have reviewed the 1099 forms before submitting as we do not handle corrected forms. Send them aW-9to collect their Taxpayer ID Number address and business name. If you paid your vendor via cash transfers with providers such as Zelle Venmo or CashApp you need to issue them a 1099-NEC.

Make a list of those who meet the qualifications for receiving a 1099-NEC. Im an s - Answered by a verified Tax Professional. If you did not sell more than 600 for that person then you do not need to send a 1099-Misc.

You do not need to send this form to vendors of storage freight merchandise or related items or when rent is paid to a real estate agent. The 1099-INT form is usually used by banks brokerage firms credit unions and sometimes even the companies handling your student loans. Payments made by PayPal or another third-party network gift card debit card or credit card also dont require a 1099.

If you dont have a W-9 completed by the vendor then you are required to. How do I file a 1099-NEC. If you would like to read more about 1099-Misc please visit this IRS page.

For each 1099 contractor you pay at least 600 in nonemployee compensation complete and file Form 1099-NEC Nonemployee Compensation. You can make corrections in a printed copy and send it by mail to the IRS. 2 You also dont need to prepare the 1099 if you pay less than 600 to that vendor in the calendar year.

If you pay an independent contractor by an online payment service like PayPal credit card or any other type of electronic payment you dont need to file a Form 1099-MISC reporting the payment to the IRS. The exception to this rule is with paying attorneys. If You Paid Someone 10 Or More For Natural Resources Forestry or Conservation Grants.

You dont need to issue 1099s for payment made for personal purposes. The filled-out W-9 is essential to staying compliant to this requirement. That business the service recipient must file Form 1099 MISC if the payment is 600 or more for the year unless the service provider is a Corporation.

The 1099-Misc is only required if you have paid over 600 to the contractor.

Friday Feature The Vendor Log And 1099 Reporting Escape Technology

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Amazon Com 1099 Misc Forms 2020 5 Part Set And 1096 Kit For 25 Vendors Complete Laser All 1099 Tax Forms In Value Pack 1099 Misc 2020 Office Products

Amazon Com 1099 Misc Forms 2020 5 Part Set And 1096 Kit For 25 Vendors Complete Laser All 1099 Tax Forms In Value Pack 1099 Misc 2020 Office Products

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Amazon Com New 1099 Nec Forms For 2020 4 Part Tax Forms Vendor Kit Of 25 Laser Forms And 25 Self Seal Envelopes Forms Designed For Quickbooks And Other Accounting Software Office Products

Amazon Com New 1099 Nec Forms For 2020 4 Part Tax Forms Vendor Kit Of 25 Laser Forms And 25 Self Seal Envelopes Forms Designed For Quickbooks And Other Accounting Software Office Products

Who Should Receive A 1099 Misc Form Affordable Bookkeeping Payroll Payroll Form Bookkeeping

Who Should Receive A 1099 Misc Form Affordable Bookkeeping Payroll Payroll Form Bookkeeping

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

16 31 Complete Laser 1099 Misc Tax Form Set And 1096 Kit For 25 Vendors 5 Part All 1099 Forms In Value Pack 1099 Mi Tax Forms 1099 Tax Form Filing Taxes

16 31 Complete Laser 1099 Misc Tax Form Set And 1096 Kit For 25 Vendors 5 Part All 1099 Forms In Value Pack 1099 Mi Tax Forms 1099 Tax Form Filing Taxes

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

1099 Nec The Dancing Accountant

1099 Nec The Dancing Accountant

1099 Misc Check 1042s Check Irs B Notices Check Realized Your Vendor Master File Needs Teaching Management Accounts Payable Cybersecurity Training

1099 Misc Check 1042s Check Irs B Notices Check Realized Your Vendor Master File Needs Teaching Management Accounts Payable Cybersecurity Training

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

Everything You Need To Know About 1099s Amy Northard Cpa The Accountant For Creatives Small Business Bookkeeping Online Marketing Quotes Small Business Tax

Everything You Need To Know About 1099s Amy Northard Cpa The Accountant For Creatives Small Business Bookkeeping Online Marketing Quotes Small Business Tax