What Does A Business Activity Statement Show

The business activity statement BAS is a form submitted to the Australian Taxation Office ATO by registered business entities to report their tax obligations including GST pay as you go withholding PAYGW pay as you go instalments PAYGI fringe benefits tax FBT wine equalisation tax WET and luxury car tax LCT. Goods and services tax GST pay as you go PAYG withholding.

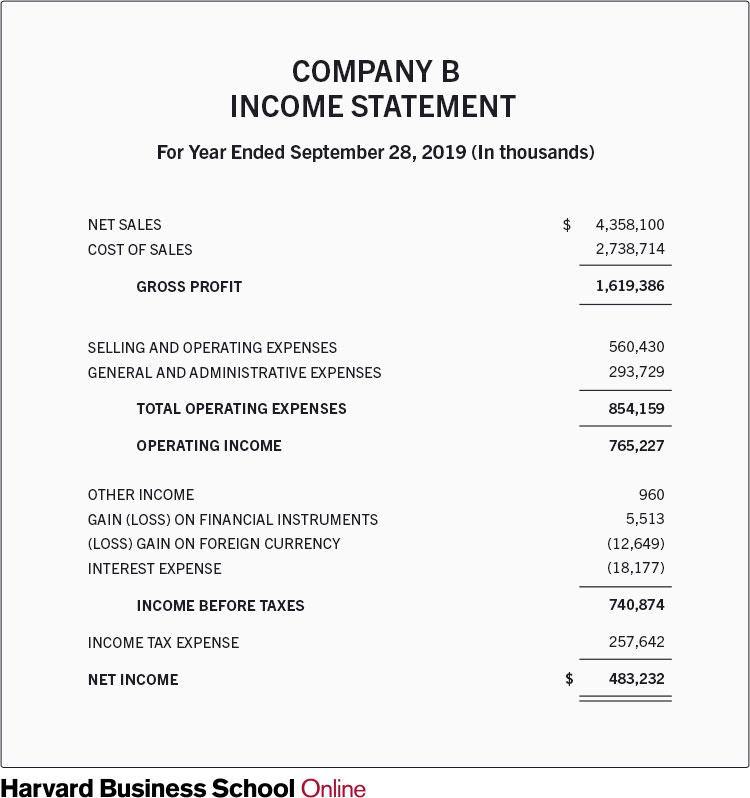

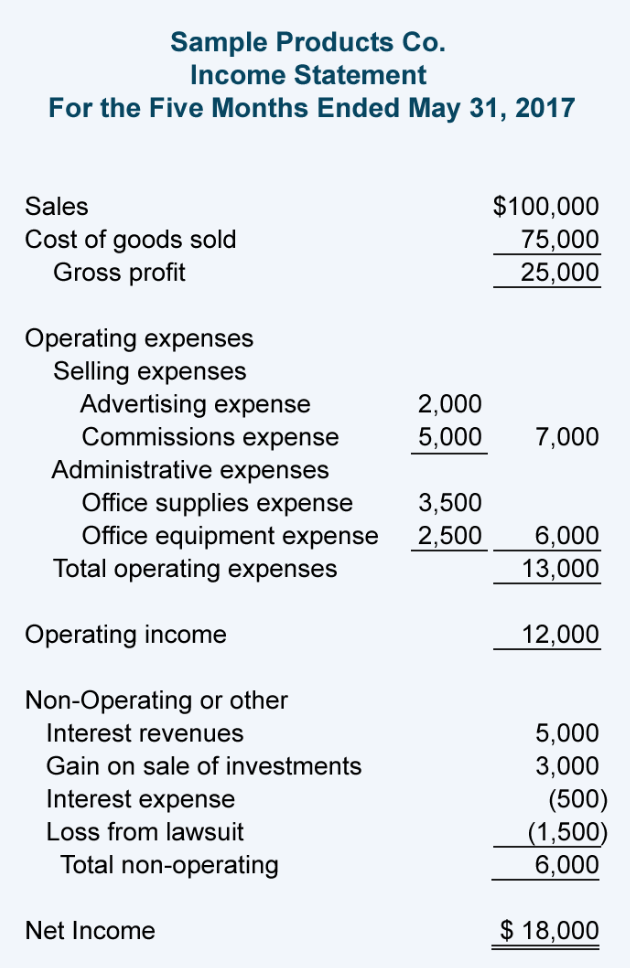

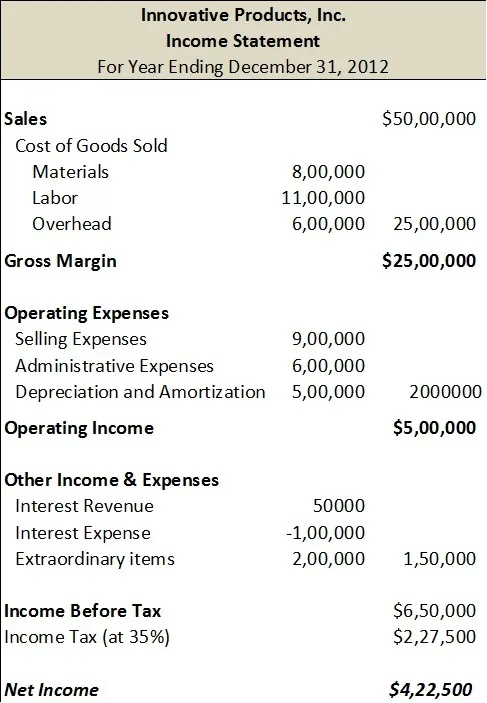

Income Statement Analysis How To Read An Income Statement

Income Statement Analysis How To Read An Income Statement

While your clients balance sheet is a snapshot view of what its company is like at a certain date a statement of activities summarizes what happened during a month quarter or full year.

What does a business activity statement show. For the Service Provider this includes transactions which the Service Provider undertakes for the Scheme as a registered GST and PAYG branch of IC 1. Business activity statement Contact phone number Authorised contact person who completed the form GST accounting method Complete Option 1 OR 2 OR 3 indicate one choice with an X Goods and services tax GST NAT 4189-112019 DE-9137 Option 2. It is an activity statement as more than just tax figures are reported.

A Business Activity Statement BAS summarises the tax that your business has paid. To use the accounts method your records must be set up so that you can easily identify GST amounts and separately record GST-free items. Your business may need to complete business activity statements BAS to report on taxes and make payments.

Under the New Tax System businesses registered for GST will report their tax obligations and entitlements on a single compliance form called the Business Activity Statement BAS. With the worksheet method you calculate the GST you owe step by step. Choose the calculation worksheet method or the accounts method.

BUSINESS ACTIVITY STATEMENT meaning. When you register for an Australian business number ABN and GST we will automatically send you a BAS when it is time to. Pay GST instalment amount quarterly.

We hope this article has explained what a Business Activity Statement or BAS is and its implications for businesses. If your business is operating in Australia youre responsible for submitting Business Activity Statements BAS to the ATO - even if you did no business during the reporting period. It reports a businesses Goods and Services Tax GST activity for.

Revenues such as contributions program fees membership dues grants investment income and amounts released from restrictions. Lodge your BAS to the ATO at regularly intervals either monthly quarterly or annually. Financial statements are written records that convey the business activities and the financial performance of a company.

The statement of activities focuses on the total organization as opposed to focusing on funds within the organization and reports the following. These instructions explain how to complete the GST section of your business activity statement BAS. Each BAS is personalised to your business and is based on your GST registration details.

A Business Activity Statement BAS is a report that is submitted by a business to the Australian Taxation Office. A BAS needs to be submitted to the ATO before the due date for final submission. Your BAS will help you report and pay your.

Activity statements Activity statements are issued by the ATO so that businesses can report and pay a number of tax liabilities on the one form at the one time. What does BUSINESS ACTIVITY STATEMENT mean. There are two types of activity statements an instalment activity statement IAS and a business.

Goods and services tax GST pay as you go PAYG instalments. The BAS form requires businesses to report. Your BAS helps you to report on taxes like.

Business activity statements BAS If you are a business registered for GST you need to lodge a business activity statement BAS. With the accounts method the information is compiled directly from your accounting records. Financial statements include the balance sheet income statement.

The statement contains details about the various types of taxes that may need to be paid by a business. Completing your BAS for GST. There are financial penalties for not paying a BAS promptly.

Business Activity Statements or BAS means the form which the Service Provider must use to report GST and various other taxes including PAYG to the Australian Taxation Office. A Business Activity Statement or more commonly referred to as a BAS is an Australian Taxation Office form issued to all GST registered entities. Calculate GST quarterly and report annually Option 3.

These statements are used to report on and pay several different types of taxes including the Goods and Services Tax GST youve collected Pay as You Go PAYG instalments or withholding Fuel Tax Credits FTC and. A companys statement of activities is a record of transactions that happened over a period of time. And if you need more assistance get in touch with Dexterous Group and get to know more about our services and packages for your business today by dropping us an email or.

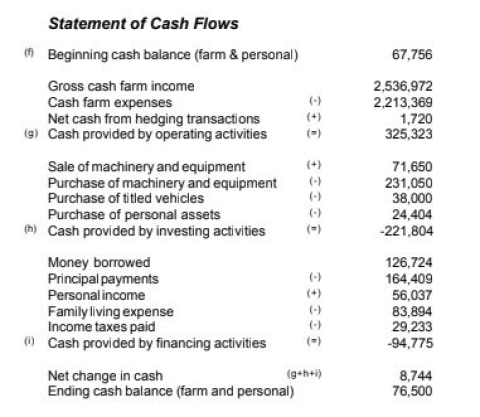

Statement Of Cash Flows Significant Non Cash Activities Cash Flow Statement Accounting Classes Bookkeeping Business

Statement Of Cash Flows Significant Non Cash Activities Cash Flow Statement Accounting Classes Bookkeeping Business

Bas What Is It And How To Lodge It Your Guide To Gst And Bas Xero Au

Bas What Is It And How To Lodge It Your Guide To Gst And Bas Xero Au

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg) Cash Flow Statement Analyzing Cash Flow From Investing Activities

Cash Flow Statement Analyzing Cash Flow From Investing Activities

The Statement Of Cash Flows Boundless Accounting

The Statement Of Cash Flows Boundless Accounting

Multi Step Income Statement An In Depth Financial Reporting Guide Freshbooks Resource Hub

Multi Step Income Statement An In Depth Financial Reporting Guide Freshbooks Resource Hub

Financial Statements Relation To The Passage Of Time It S Easy To Read Financial Statements Financial Statement Financial Statement

Financial Statements Relation To The Passage Of Time It S Easy To Read Financial Statements Financial Statement Financial Statement

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg) Financial Statements Definition

Financial Statements Definition

How To Calculate The Cash Flow From Investing Activities The Blueprint

How To Calculate The Cash Flow From Investing Activities The Blueprint

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg) Financial Statements Definition

Financial Statements Definition

What Is An Income Statement Financial Reports For Small Businesses

What Is An Income Statement Financial Reports For Small Businesses

Sample Financial Reports Report Templates Annual For School Example Within Quarterly Re Income Statement Personal Financial Statement Profit And Loss Statement

Sample Financial Reports Report Templates Annual For School Example Within Quarterly Re Income Statement Personal Financial Statement Profit And Loss Statement

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg) Financial Statements Definition

Financial Statements Definition

The Crime And Passion Blog Profit And Loss Statements For Independent Publishers Profit And Loss Statement Statement Template Bookkeeping Business

The Crime And Passion Blog Profit And Loss Statements For Independent Publishers Profit And Loss Statement Statement Template Bookkeeping Business

An Example Profit Amp Loss Statement To Help You With Your Smallbusines Ilovetobeselling Profit And Loss Statement Tax Refund Income Statement

An Example Profit Amp Loss Statement To Help You With Your Smallbusines Ilovetobeselling Profit And Loss Statement Tax Refund Income Statement

How To Read The Balance Sheet Understand B S Structure Content Balance Sheet Financial Statement Balance

How To Read The Balance Sheet Understand B S Structure Content Balance Sheet Financial Statement Balance

Financial Statements Examples Amazon Case Study

Financial Statements Examples Amazon Case Study

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)