How To Register Sole Proprietorship In Illinois

If youre a Sole Proprietor you need a DBA to register your business name. Decide if you will run your business under your legal name or under an assumed business name.

5 Super Slick Tips For Your Sole Proprietorship Sole Proprietorship Small Business Coaching Business Books

5 Super Slick Tips For Your Sole Proprietorship Sole Proprietorship Small Business Coaching Business Books

If you are a sole proprietor use the information in the chart below to help you determine some of the forms that you may be required to file.

How to register sole proprietorship in illinois. You must complete this registration before you make any purchases sales or hire any employees. However business owners need. All Illinois businesses including sole proprietorships must register with the Illinois Department of Revenue.

Illinois DBA Registration Form Sole proprietorships and partnerships Obtain the Assumed Business Name Application from the County Clerks office in the county where the business is physically located. A corporation is a distinct legal entity and is the most complex. Get started Starting at 99 state filing fees.

If you are a sole proprietorship or general partnership in Illinois and doing business under your full first and last name John Smith for example there is no filing but if the business will operate under a trade name or fictitious business name like John Smiths Handyman Service Mr. Acquire an EINTax Identification Number. Choose a Business Name.

Sole proprietors must register using their legal name or file an assumed business name. File an Assumed Business Name. A sole proprietor is someone who owns an unincorporated business by himself or herself.

You may register online using the Illinois Business Gateway. How to Start a Sole Proprietorship in Illinois. Although you are not required to do so you should consider registering your business name as a.

To establish a sole proprietorship in Illinois heres everything you need to know. In Illinois you do this by applying for permission to use an assumed name with the county clerks office in the county where your principal place of business will be located. A handful of counties have this form available to download but most require the form to be picked up in person.

When it comes to being a sole proprietor in the state of Illinois there is no formal setup process. 18002522904 Limited Liability Partnership. Accomplish Other Necessary.

Handyman etc you will need to file an Assumed Business Name Registration commonly known as a DBA Doing. There are also no fees involved with forming or maintaining this business type. You need to register for a motor fuel permit You already hold one or more other permits with the Department of Revenue Otherwise - Click on the One Stop Business Registration to register your business with multiple agencies including the Department of Financial Institutions and the Department of Workforce Development.

In Illinois a sole proprietor may use his or her own given name or may use an assumed business name or trade name. File Your Chosen Business Name. If organized as a Limited Liability Partnership under a specific section of the.

Create a plan for your Illinois business. DBA is an abbreviation for doing business as Well prepare and file all required documents to start your Illinois DBA. Is a multi-agency effort to replace Illinois 30-year-old Medicaid Management Information System MMIS with a web-based system that meets federal requirements is more convenient for providers and increases efficiency by automating and expediting state agency processes.

A provider who owns his or her own. How to Become an Illinois Sole Proprietor. If you want to operate an Illinois sole proprietorship all you need to do is start working.

Even though a sole proprietorship is often seen as an informal structure because you are not required to. However if you are the sole member of a domestic limited liability company LLC you are not a sole proprietor if you elect to treat the LLC as a corporation.

5 Super Slick Tips For Your Sole Proprietorship Small Business Coaching Sole Proprietorship Business Books

5 Super Slick Tips For Your Sole Proprietorship Small Business Coaching Sole Proprietorship Business Books

Illinois Plumbers Sole Proprietor Surety Bond Bond Plumbing Contractor Illinois

Illinois Plumbers Sole Proprietor Surety Bond Bond Plumbing Contractor Illinois

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

How To Change From A Sole Proprietor To An Llc

How To Change From A Sole Proprietor To An Llc

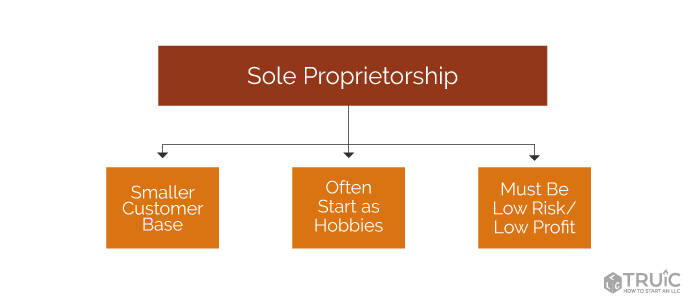

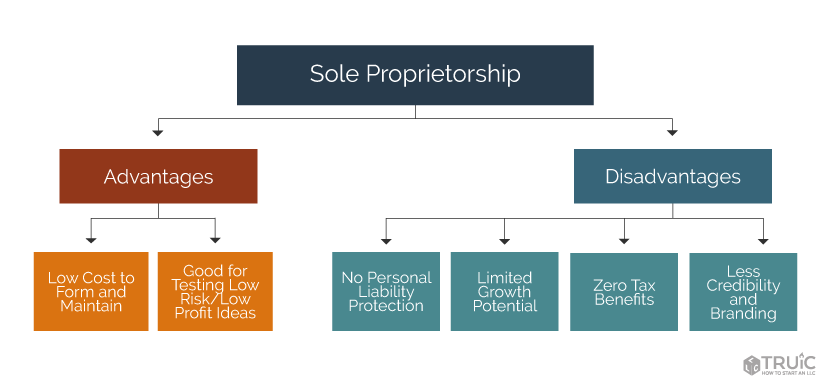

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

Why You Should Turn Your Sole Proprietorship Into An Llc

Why You Should Turn Your Sole Proprietorship Into An Llc

A Sole Proprietorship Is A Type Of Business Where There Is Only One Owner And There Is No Legal Judgement Between Life Balance Work Life Balance Working Life

A Sole Proprietorship Is A Type Of Business Where There Is Only One Owner And There Is No Legal Judgement Between Life Balance Work Life Balance Working Life

How To Set Up A Sole Proprietorship In Illinois 8 Steps

How To Set Up A Sole Proprietorship In Illinois 8 Steps

Sole Proprietorship Laws In Illinois Legalzoom Com

Sole Proprietorship Laws In Illinois Legalzoom Com

Business Broker Agreement Template Best Of 7 Sample Real Estate Employment Agreements Agreement Web Design Contract Templates

Business Broker Agreement Template Best Of 7 Sample Real Estate Employment Agreements Agreement Web Design Contract Templates

Register Illinois Fictitious Business Name Illinois Trade Name Illinois Dba Business Format Sole Proprietor Illinois

Register Illinois Fictitious Business Name Illinois Trade Name Illinois Dba Business Format Sole Proprietor Illinois

When Does A Sole Proprietor Need An Ein How To Start An Llc

When Does A Sole Proprietor Need An Ein How To Start An Llc

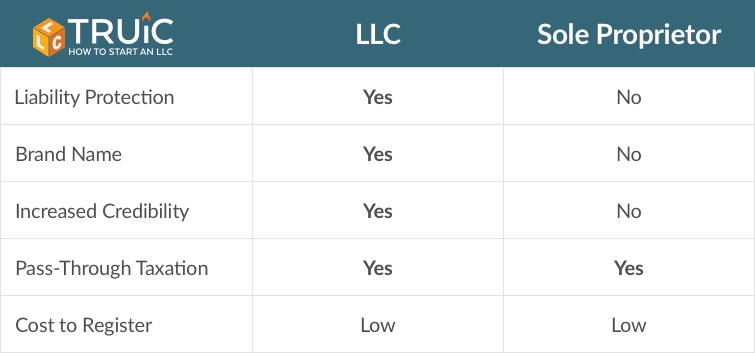

Sole Proprietorship Vs Llc A Truic Small Business Guide

Sole Proprietorship Vs Llc A Truic Small Business Guide

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

How To Set Up A Sole Proprietorship In Illinois 8 Steps

How To Set Up A Sole Proprietorship In Illinois 8 Steps

How To Set Up A Sole Proprietorship In Illinois 8 Steps

How To Set Up A Sole Proprietorship In Illinois 8 Steps

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide