How To Claim Business Mileage From Hmrc

Increase your annual mileage according to the applicable AMAP rate. To claim back your self-employed mileage allowance you simply need to include the amount in the expenses section of your self-assessment tax return.

Get Organised For Your Accountant Tax Return Bookkeeping Business Self Assessment

Get Organised For Your Accountant Tax Return Bookkeeping Business Self Assessment

To determine how much you could claim work out how much of the mileage allowance would be used for fuel.

How to claim business mileage from hmrc. The RIFT mileage expenses calculator is the first step towards claiming your business mileage back from HMRC. On your self-assessment tax return. You then multiply this by 0166 20 VAT divided by 120 100 plus 20 to figure out the pence per mile in this case 233p.

Find out how much you can claim. You will usually receive 20 - 40 of the final amount back as a rebate depending on the rate of tax you pay. A petrol car with a 25 litre engine does business miles totalling 18000 over the course of the year.

Using your own vehicle for work. Mileage Claim Calculator - Claim Your. With mileage allowance youre required to calculate the amount to claim.

This is how I would do it in five simple steps. Keep a record of the business mileage you have travelled throughout the tax year. You have up to four years from the end of the fiscal year to claim it.

Can I claim the journey there and back from home as a business expense mileage as it is not a regular place of work. You must claim within 4 years of the end of the tax year that you spent the money. What is mileage allowance meant to cover.

Keep a record of your business mileage. Include the amount in your total expenses on your Self Assessment tax return. I do not get paid any travel amount from the agency.

Mileage Allowance Relief can be calculated by multiplying your business mileage by the Approved Rates set out below. If the employee drives their own car usually the mileage payback is calculated according to approved mileage allowance payments AMAP set by HMRC. Add up your business mileage for the whole year.

If you usually do not need to complete a tax return you can use form P87 on HMRCs website to claim MAR. Multiply business miles travelled with the simplified expenses rate for the whole tax year. Are employed or self-employed this holds true whether youre a sole trader a partner in a partnership or do business as a limited liability company.

Deduct your employers mileage limit if applicable. If your employer reimburses you for your business mileage you can only claim the difference between what your employer paid you and the AMAP rate. There are different rates for different circumstances.

Find out how much you can claim. The VAT which can be reclaimed on the mileage claims over the year totals 630. For this you must use the number of miles travelled for business and the type or types of vehicle used along the way.

Mileage tax relief is by far the largest part of most tax refund claims and refund claims can stretch back over 4 years so its not too late to get back the mileage expenses youre already owed. You have as long as four years from the finish of the fiscal year to claim it. Add up the Mileage Allowance Payments you have received throughout the year.

If you dont pay them business mileage or you pay them less than the HMRC approved mileage rates they can make a claim to HMRC at the end of the tax year for the difference. If you are keeping track of things yourself remember the HMRCs flat rates. Keep records of the dates and mileage or your work journeys.

If your claim is for the current tax year HM Revenue and Customs HMRC. Claiming Business Mileage - Self Employed As a self-employed person you can claim back mileage from HMRC if you use your personal vehicle for business trips. How much can be claimed as business mileage.

Posted Mon 27 Apr 2020 110600 GMT by HMRC Admin 2. Add up the mileage for each vehicle type youve used for work. This will give you the amount on which you can claim tax relief amount not the rebate.

Subtract the received MAP from the approved amount you should have received. James drives 20000 miles annually using his personal car so he has the right to claim 7000 10000 x 045 10000 x 025 7000. Multiply your yearly mileage by the applicable AMAP rate.

VAT on mileage claims Example. You should file a return with HMRC. According to HMRC these trips are defined as journeys you make wholly and exclusively for business purposes.

As of June 2018 a 1401cc to 2000cc petrol car would have an AFR of 14p per mile. You can then submit it to HMRC for consideration and approval if everything checks out. It is calculated as follows.

45p per mile for your first 10000 miles and 25p per mile for everything above 10000 miles. Alternatively to claim vehicle costs using the simplified expenses method you must. VAT Fuel Advisory Rate x Business Miles 6.

Take away any amount your employer pays you towards your costs sometimes called a mileage allowance. Its usually best to claim back your mileage using the HMRC approved mileage allowance payments AMAP rates on Govuk. When you are completing your tax return the mileage calculation comes under Car van and travel expenses on the self assessment form.

Multiply your business mileage by HMRCs Approved Mileage Allowance Payment rate or AMAP. Keep accurate records of your business mileage. If youre an employee claiming less than 2500 business mileage use Form P87.

Keep a record of your business mileage. Heres how to do this in five easy steps. You can claim a business mileage allowance using AMAP rates if you.

The AMAP rates include the general running costs of. For amounts under 2500 file your claim.

What You Need To Know About Owner Operator Vs Company Driver Taxes Right Now Trucking Business Tax Company

What You Need To Know About Owner Operator Vs Company Driver Taxes Right Now Trucking Business Tax Company

Freelancer S Guide To Car Tax Deductions

Freelancer S Guide To Car Tax Deductions

Sole Trader Bookkeeping Spreadsheet Goselfemployed Co Spreadsheet Bookkeeping Business Checklist

Sole Trader Bookkeeping Spreadsheet Goselfemployed Co Spreadsheet Bookkeeping Business Checklist

Free Self Employed Bookkeeping Spreadsheet Go Self Employed Spreadsheet Template Spreadsheet Design Bookkeeping

Free Self Employed Bookkeeping Spreadsheet Go Self Employed Spreadsheet Template Spreadsheet Design Bookkeeping

How To Claim Business Mileage Why It S Ok For The Business

How To Claim Business Mileage Why It S Ok For The Business

3 Ways To Record Business Miles Wikihow

3 Ways To Record Business Miles Wikihow

Did You Know That If Your Business Turns Over Less Than 1 000 In Your Business You May Not Need To Pay Any Tax Or Ev Allowance Tax Free Small Business Finance

Did You Know That If Your Business Turns Over Less Than 1 000 In Your Business You May Not Need To Pay Any Tax Or Ev Allowance Tax Free Small Business Finance

Automating Mileage Claims In The Uk Mileage App Mileage Tracking App About Uk

Automating Mileage Claims In The Uk Mileage App Mileage Tracking App About Uk

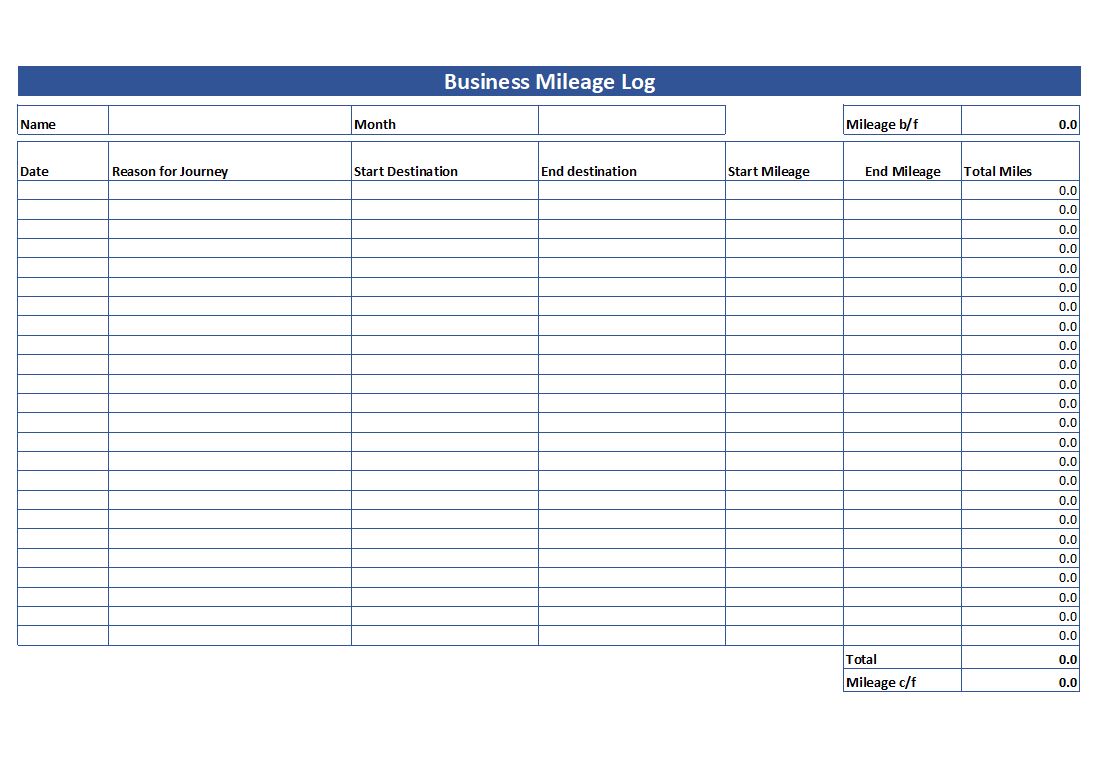

Simple Mileage Log Free Mileage Log Template Download

Simple Mileage Log Free Mileage Log Template Download

Truefleet Gps Mileage Capture Www Truefleet Co Uk Capture Mileage Gps

Truefleet Gps Mileage Capture Www Truefleet Co Uk Capture Mileage Gps

3 Ways To Record Business Miles Wikihow

3 Ways To Record Business Miles Wikihow

Calculate Business Mileage Using Hmrc S Rates For 2018 Mileiq Uk

Calculate Business Mileage Using Hmrc S Rates For 2018 Mileiq Uk

3 Ways To Record Business Miles Wikihow

3 Ways To Record Business Miles Wikihow

The Irs Mileage Deduction Lets You Write Off Miles For Taxes See The Standard Mileage Rates For 2017 2016 Amp Previous Mileage Deduction Mileage Guide Book

The Irs Mileage Deduction Lets You Write Off Miles For Taxes See The Standard Mileage Rates For 2017 2016 Amp Previous Mileage Deduction Mileage Guide Book

Free Mileage Log Template For Taxes Track Business Miles Mileiq Uk

Free Mileage Log Template For Taxes Track Business Miles Mileiq Uk

Hmrc Form P87 What You Need To Know For Taxes

Hmrc Form P87 What You Need To Know For Taxes

Self Employed Guide How To Claim For Business Mileage

Self Employed Guide How To Claim For Business Mileage

If You Re Looking For A Simple Way To Keep Track Of Your Finances In Your Business Then You Re In The Business Planner Free Small Business Planner Bookkeeping

If You Re Looking For A Simple Way To Keep Track Of Your Finances In Your Business Then You Re In The Business Planner Free Small Business Planner Bookkeeping