How To Get A Government Home Loan

It insures mortgage loans from FHA-approved lenders against default. There are two types of home.

Complete List Of Mortgage Application Documents Hsh Com Refinance Mortgage Mortgage Tips Mortgage Loans

Complete List Of Mortgage Application Documents Hsh Com Refinance Mortgage Mortgage Tips Mortgage Loans

You can contact a Government Loan Specialist at FedHome Loan Centers now by calling.

How to get a government home loan. SBA loans should be your first choice and theyre available through many local banks and credit unions. Find out how to apply for a Certificate of Eligibility COE to show your lender that you qualify based on your service history and duty status. Are you looking to buy or rent a home but fear your financial situation wont allow it.

How Do I Apply. FedHome Loan Centers specializes in delivering advantageous government loan products and providing solutions for customers seeking flexible credit qualifying requirements with low out-of-pocket costs. Contact a HUD-approved housing counselor or call.

The loan-to-value ratio must be greater than 80 percent meaning you have less than 20 percent equity in the home. You must qualify for a loan with an FHA-approved lender. Some homeowners might owe more than the home is.

Housing loans are not directly funded by the federal government. If you need help starting or growing your venture evaluate government loan programs first. Search for Government Loans Use the federal governments free official website GovLoansgov rather than commercial sites that may charge a fee for information or application forms.

Citizens can apply for home grants to purchase homes buy income and rental property and renovate real estate. Today the best loan products for someone with. Types of Home Equity Loans.

Find an FHA lender. It insures mortgage loans from FHA-approved lenders against default. Learn about government programs to help pay bills and other expenses.

Assistance is given in the form of home grants down-payment assistance and low-interest loans. Although the government helps you qualify by guaranteeing loans you still need to put skin in the game. You can use it to pay for major expenses including education medical bills and home repairs.

Home Equity Loans. Keep in mind that for a VA-backed home loan youll also need to meet your lenders credit and income loan requirements to receive financing. The FHA doesnt lend money to people.

How Do I Apply. Lending institutions make loans from their own funds to. The FHA doesnt lend money to people.

They are very popular with first-time homebuyers with their low down payment and credit requirements. The Federal Housing Administration FHA makes it easier for consumers to obtain affordable home improvement loans by insuring loans made by private lenders to improve properties that meet certain requirements. To get a government housing loan youll need to work with an approved bank or online lending service.

877-432-LOAN 877-432-5626 We Know Government Loans. Read whats included in the Coronavirus Aid Relief and Economic Security CARES Act. Some of the most common government housing loans include FHA loans USDA loans VA.

We have two loan products - one for those who own the land that the home is on and another for mobile homes that are - or will be - located in mobile home parks. GovLoansgov is an online resource to help you find government loans you may be eligible for. Learn about benefits and assistance available to military members veterans and their families.

You must qualify for a loan with an FHA-approved lender. The price of the home you want to insure must be within the loan limit for an FHA home in its location. A home equity loan is a form of credit where your home is used as collateral to borrow money.

The price of the home you want to insure must be within the loan limit for an FHA home in its location. But if you cannot pay back the loan the lender could foreclose on your home. GovLoansgov directs you to information on loans for agriculture business disaster relief education housing and for veterans.

Ask an FHA lender to tell you more about FHA loan products. It is not an application for benefits and will not send you free money. In general your credit score doesnt need to be high.

Learn about government grants and loans for states and organizations. In general your credit score doesnt need to be high. FHA loans have the lowest credit requirements of any mortgage loan type requiring a 500 credit score with 10 down or a 580 credit score with 35 down.

Kentucky Usda Rural Housing Loans How Long Does It Take To Close A Usda Loan In Kentucky Usda Loan Usda Mortgage

Kentucky Usda Rural Housing Loans How Long Does It Take To Close A Usda Loan In Kentucky Usda Loan Usda Mortgage

6 Steps To Buying A Home Home Buying How To Find Out Mortgage Tips

6 Steps To Buying A Home Home Buying How To Find Out Mortgage Tips

How To Qualify For A Kentucky Fha Home Loan Fha Mortgage Mortgage Loans Fha Loans

How To Qualify For A Kentucky Fha Home Loan Fha Mortgage Mortgage Loans Fha Loans

Home Loan Cheat Sheet A Quick Run Down On Some Of The Most Common Loan Programs Click For More Information On Popular Home Mortgage Mortgage No Credit Loans

Home Loan Cheat Sheet A Quick Run Down On Some Of The Most Common Loan Programs Click For More Information On Popular Home Mortgage Mortgage No Credit Loans

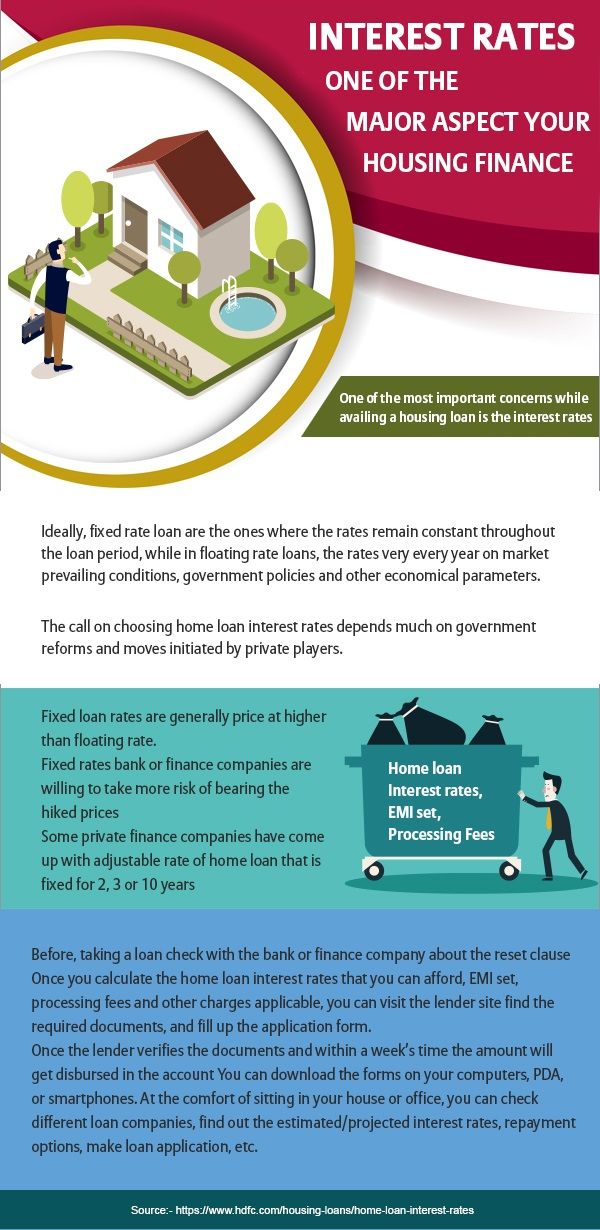

House Loan Interest Rates Create A Space Of Your Own With Hdfc Home Loans Best Housing Loan Interest Rates For Loan Interest Rates Home Loans Interest Rates

House Loan Interest Rates Create A Space Of Your Own With Hdfc Home Loans Best Housing Loan Interest Rates For Loan Interest Rates Home Loans Interest Rates

We Can Help Our Clients With Most Types Of Residential Mortgages This Flyer Covers Just A Few Options We Offer Make Sur Mortgage Mortgage Help Things To Know

We Can Help Our Clients With Most Types Of Residential Mortgages This Flyer Covers Just A Few Options We Offer Make Sur Mortgage Mortgage Help Things To Know

Fha Has Made Many People Eligible For A Home Loan Through Easy Terms And Favorable Guidelines It Has Supported Even Those Persons W Fha Loans Fha Mortgage Fha

Fha Has Made Many People Eligible For A Home Loan Through Easy Terms And Favorable Guidelines It Has Supported Even Those Persons W Fha Loans Fha Mortgage Fha

Credit Scores Needed To Qualify For A Kentucky Mortgage Loan Approval Louisville Kentucky Mortgage Loans No Credit Loans Credit Score Loans For Bad Credit

Credit Scores Needed To Qualify For A Kentucky Mortgage Loan Approval Louisville Kentucky Mortgage Loans No Credit Loans Credit Score Loans For Bad Credit

Concession In Home Loan Interest Rates Clss Pmay U Home Loans Loan Interest Rates Interest Rates

Concession In Home Loan Interest Rates Clss Pmay U Home Loans Loan Interest Rates Interest Rates

Credit Scores Required For A Kentucky Mortgage Loan Approval In 2021 Credit Score Mortgage Infographic Mortgage Lenders

Credit Scores Required For A Kentucky Mortgage Loan Approval In 2021 Credit Score Mortgage Infographic Mortgage Lenders

The 2nd Kind Of Loan The Fha Title I Loan Belongs To An Us Federal Government Sponsored Program Meant To Home Improvement Loans Home Buying Process Mortgage

The 2nd Kind Of Loan The Fha Title I Loan Belongs To An Us Federal Government Sponsored Program Meant To Home Improvement Loans Home Buying Process Mortgage

Types Of Kentucky Mortgage Loans To Consider After Bankruptcy Mortgage Loans Mortgage First Time Home Buyers

Types Of Kentucky Mortgage Loans To Consider After Bankruptcy Mortgage Loans Mortgage First Time Home Buyers

Texas Mortgage Loan Va Loan Mortgage Loans Refinance Mortgage

Texas Mortgage Loan Va Loan Mortgage Loans Refinance Mortgage

Find The Best Loan That Fits Your Life And Budget Great Pin Which Fits You The Home Mortgage Home Buying Process Home Buying

Find The Best Loan That Fits Your Life And Budget Great Pin Which Fits You The Home Mortgage Home Buying Process Home Buying

Home Loan Home Loans Bank Of Baroda Loan

Home Loan Home Loans Bank Of Baroda Loan

Kentucky Va Mortgage Loan Information Va Mortgage Loans Refinance Loans Va Mortgages

Kentucky Va Mortgage Loan Information Va Mortgage Loans Refinance Loans Va Mortgages

What Is The Minimum Credit Score Needed To Buy A House And Get A Kentucky Mortgage Loan Mortgage Lenders Mortgage Loans Mortgage

What Is The Minimum Credit Score Needed To Buy A House And Get A Kentucky Mortgage Loan Mortgage Lenders Mortgage Loans Mortgage

Help To Buy Schemes New Builds First Time Investment Property

Help To Buy Schemes New Builds First Time Investment Property